![]()

BlackRock: Inflation concerns and sustainability driving bond ETF flows in EMEA

Brett Olson, Head of iShares Fixed Income EMEA, explores the top themes influencing how clients are thinking about their fixed income portfolios

- Inflation and rate volatility top of mind

- Sustainability inflows contrast broader fixed income outflows

- High yield and emerging markets in the spotlight amid search for yield

Are we in a rising rate environment?

- This is the key question on the lips of many investors looking to shore up their fixed income exposures against the potential for inflation and rate volatility.

- Looking beyond the transitory nature of the current inflation surge linked to the reopening dynamic, the BlackRock Investment Institute (BII) points to inflation building steadily over the medium-term as easy monetary policy allows the U.S. economy to run hot.

- Bond ETF flow data show investors are moving their allocations to use inflation-linked bonds with YTD inflows of $3.0bn at 31 May 2021, vs. $4.2bn for the entire of 2020*, as well as short duration corporate and government bonds to minimise rate volatility.

- The liquid, flexible nature of fixed income ETFs is enabling investors to remain nimble and stay adaptable to changing market conditions.

Investors are committed to their sustainability journey

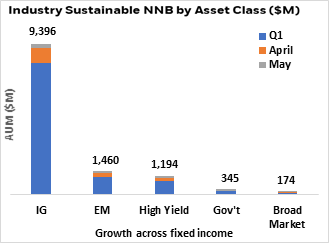

- Sustainable flows across all major fixed income asset classes continued to be positive with total flows into fixed income ESG ETFs coming up to $12.6bn as at end of 31 May 2021, mainly driven by investment grade credit, which accounted for 73% of this total.

- Sustainable fixed income ETF flows are by far exceeding industry inflows into traditional, non-ESG exposures year-to-date – which stood up to only about $3.3bn as of end 31 May 2021*.

- Investors increasingly want to understand the impact of sustainability on their fixed income sleeve. Despite growing investor caution on fixed income as an asset class in recent months, the trend of switching out of traditional or non-ESG funds and actively transitioning into sustainable exposures is accelerating.

Fig.1: UCITS Fixed Income Sustainable ETF flows

![]()

The search for yield continues

- Today’s fixed income markets are mainly driven by central bank policies, which in turn have caused negatively yielding debt to grow at a record pace. The extraordinary level of central bank stimulus has pushed interest rates lower, and as a result, the search for yield has never been stronger.

- High Yield [“HY”] continues to be in favour by investors in 2021, as it is also a lower duration asset class, relative to Investment Grade, in addition to its strong fundamentals. HY ETFs saw $2bn of inflows as at 31 May 2021, with a strong preference for USD HY exposures supported by lower EUR/USD hedging costs, along with the higher exposure to energy names.

· HY has traditionally been viewed through a lens of requiring specialist knowledge and expertise in order to ‘pick and choose’ between the best names in the sector. However, as the ongoing hunt for yield continues, HY debt may benefit from inflationary pressures as investors may prefer the shorter duration exposures that HY offers versus investment grade debt. In this space, more and more clients are using ETFs to bring diversification and flexibility to their portfolio alongside alpha and index exposures.

· Looking at the portion of the fixed income market which yields over 2.5%, more than half is made up of China bonds and investors are increasingly taking note: the 5-year China government bond yield is at 3.0% compared to the equivalent 5-year US Treasury which is yielding just 0.9%, offering a 2.1% yield pick-up. The inclusion of onshore bonds into global indices provides a structural tailwind and low correlation with other major markets is attracting investors looking to build resilience against market volatility.

· Against this backdrop China on shore bond ETFs gathered more than $4bn inflows as at 31 May 2021, mainly used for strategic asset allocation purposes from a diverse set of investors across asset owners, asset managers and wealth as well as from multiple regions.

Fig 2: Comparing returns across asset classes

Source: BlackRock, Bloomberg as at 31/05/21. For illustrative purposes only.

For more information on these trends, or to speak with one of our fixed income specialists, please contact us.

Risk Warnings

Capital at risk

The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

Past performance is not a reliable indicator of current or future results and should not be the sole factor of consideration when selecting a product or strategy.

Changes in the rates of exchange between currencies may cause the value of investments to diminish or increase. Fluctuation may be particularly marked in the case of a higher volatility fund and the value of an investment may fall suddenly and substantially. Levels and basis of taxation may change from time to time.

Important Information

This material is for distribution to Professional Clients (as defined by the Financial Conduct Authority or MiFID Rules) only and should not be relied upon by any other persons.

Until 31 December 2020, issued by BlackRock Investment Management (UK) Limited, authorised and regulated by the Financial Conduct Authority. Registered office: 12 Throgmorton Avenue, London, EC2N 2DL. Tel: + 44 (0)20 7743 3000. Registered in England and Wales No. 02020394. For your protection telephone calls are usually recorded. Please refer to the Financial Conduct Authority website for a list of authorised activities conducted by BlackRock. From 1 January 2021, in the event the United Kingdom and the European Union do not enter into an arrangement which permits United Kingdom firms to offer and provide financial services into the European Economic Area, the issuer of this material is: (i) BlackRock Investment Management (UK) Limited for all outside of the European Economic Area; and (ii) BlackRock (Netherlands) B.V. for in the European Economic Area, BlackRock (Netherlands) B.V. is authorised and regulated by the Netherlands Authority for the Financial Markets. Registered office Amstelplein 1, 1096 HA, Amsterdam, Tel: 020 – 549 5200, Tel: 31-20-549-5200. Trade Register No. 17068311 For your protection telephone calls are usually recorded.

For qualified investors in Switzerland: This document is marketing material. Until 31 December 2021, this document shall be exclusively made available to, and directed at, qualified investors as defined in the Swiss Collective Investment Schemes Act of 23 June 2006 (“CISA”), as amended. From 1 January 2022, this document shall be exclusively made available to, and directed at, qualified investors as defined in Article 10 (3) of the CISA of 23 June 2006, as amended, at the exclusion of qualified investors with an opting-out pursuant to Art. 5 (1) of the Swiss Federal Act on Financial Services (“FinSA”). For information on art. 8 / 9 Financial Services Act (FinSA) and on your client segmentation under art. 4 FinSA, please see the following website: www.blackrock.com/finsa

BlackRock has not considered the suitability of any investment against your individual needs and risk tolerance.

Any research in this document has been procured and may have been acted on by BlackRock for its own purpose. The results of such research are being made available only incidentally. The views expressed do not constitute investment or any other advice and are subject to change. They do not necessarily reflect the views of any company in the BlackRock Group or any part thereof and no assurances are made as to their accuracy.

This document is for information purposes only and does not constitute an offer or invitation to anyone to invest in any BlackRock funds and has not been prepared in connection with any such offer.

© 2021 BlackRock, Inc. All Rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, iSHARES, BUILD ON BLACKROCK and SO WHAT DO I DO WITH MY MONEY are trademarks of BlackRock, Inc. or its subsidiaries in the United States and elsewhere. All other trademarks are those of their respective owners.