Daniel Casali, Chief Investment Strategist at Tilney Smith & Williamson, the wealth management and professional services group, comments on the publication of February flash UK PMI data:

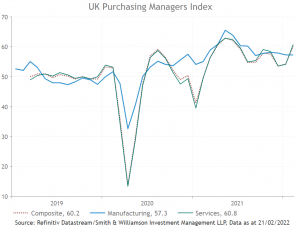

The February flash UK composite PMI (manufacturing and services) came in at 60.2, much higher than consensus expectations of 55.3, and is up from 54.2 in January. The upward surprise was mainly led by the service sector, with a reading of 60.8, vs a consensus of 55.5 and 54.1 reported in January. The manufacturing sector came in at 57.3, slightly ahead of consensus expectations of 57.0, but it is unchanged from January.

Along with other surveys (i.e. CBI industrial trends), the UK PMI data shows that the economy is holding up fairly well and that the uncertainty from the pandemic is dissipating, as the government lifts COVID restrictions in England.

Breaking down the data, the manufacturing sector continues to show strength as firms rebuild stocks from low levels brought about by supply chain disruptions. The service sector PMI data also suggests that consumer demand remains firm so far this year. That’s because it is supported by a strong labour market, an expected decline in the household savings rate and pent-up demand from the pandemic.

This view tallies with high frequency data. The ONS now releases an experimental dataset that covers UK nominal daily spending on credit/debit cards (a proxy of consumption) from around 100 major UK retail corporates. The YTD data up to the middle of February shows that retail expenditure on credit/debit cards was up over 30% compared to a year ago.

Despite consumer-facing headwinds from rising food and energy costs, higher mortgage rates and a rise in National Insurance, the forward-looking surveys and recent data suggests that UK growth is holding up. Overall, the consensus of economists expects solid 4.3% UK real growth in 2022. This leaves room for company earning upgrades and investor sentiment improvement in UK stocks from relatively cheap market valuations.