By Colin Graham, Head of Multi-Assets Strategies and Peter van der Welle, Strategist Global Macro Team.

- Equities and commodities should perform best as economies recover

- Covid has become more manageable and should not be as disruptive

- Headwinds include the US mid-terms and any Chinese slowdown

Equities and commodities remain the favored asset classes of multi-asset Portfolio Manager Colin Graham and Strategist Peter van der Welle. However, headwinds next year include Covid 3.0 (which is already with us), the US mid-term elections and China’s economic slowdown.

The preferences of the Robeco multi-asset team were first laid out in their five-year outlook, Expected Returns 2022-2026, published in September. Since the emergence of Omicron as the latest and most contagious variant of Covid-19, investors have been forced to reevaluate their forecasts for 2022. Equities remain the top pick, but returns are likely to come sooner rather than later as central banks start raising interest rates, they say.

“For us, economic momentum, interest rates and liquidity are all highly supportive for risky assets, though any US lockdown could cause us to question this outlook,” says Graham, Head of the Multi-Asset team. “From here, it’s more likely that we’re going to get the equity returns this year rather than next year or the year after that – returns will be front-end loaded.”

Excess liquidity

“The excess liquidity that we have now will decline substantially once the tightening cycle is well underway in 2023 and 2024. And it’s very likely that the Bank of England and even the ECB will join the Fed in tightening by 2023 or 2024.”

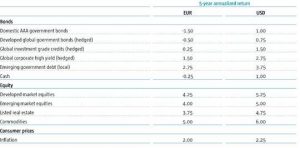

Predictions for the likely performance of the major asset classes over the next five years in Expected Returns 2022-2026. Source: Robeco.

“The correlation between equity market returns and the balance sheet expansion of central banks has been very high and positive. If balance sheet expansion decelerates, as we envisage over a two to five-year horizon in our main Expected Returns outlook, then indeed it’s likely that equity returns will be front-end loaded from that perspective as well.”

“For stocks, earnings expectations are too low for next year given nominal growth, which is supportive for equity and credits, says Van der Welle. “We think earnings expectations will rise over the coming year: margins are currently high, though they will start to fall when input costs and in particular labor costs start to go up later in 2022.”

“So, we do see more upside in equities for at least the next few quarters, and equity risk premiums are still positive relative to bonds.”

Facing Covid 3.0

While the Covid-19 pandemic remains a major problem, it has at least moved from the ‘great unknown’ when it first hit in early 2020 to something ‘better known’ now that vaccines are reducing its impact.

“There could there be more virulent strains of Covid as we’re now seeing with the Omicron variant as that’s what viruses do – they mutate and become more contagious,” says Graham. “But at least now we have a road map for how governments can deal with the public health threat.”

“We should have seen a 1930s-style depression in financial markets when Covid first hit in 2020, but we didn’t because of government action and the fiscal stimulus that kept the economy ticking over. It has all become more manageable and we now have a modus operandi in place.”