- Economic stalemate, mild recession in 2024, inflation stabilizes around 2.5%

- Transitioning from era of low rates and high equity risk premiums, to era of high rates and low equity risk premiums

- Fair spreads with only a mild recession lead to higher expected corporate bond returns

Robeco today presented its thirteenth annual Expected Returns report. The 5-year outlook predicts significant power dynamics that will shape the economic landscape in the coming years. These dynamics include the friction caused by deploying capital at the expense of labor, the battle between fiscal and monetary policy, and the deteriorating relations between the United States and China.

Capital versus labor

Over recent decades, corporate profits surged to record highs, while labor’s share in the economy declined. Challenges to corporate profits could emerge from reshoring. Relocating business or bringing back production to the home country might give labor more bargaining power. A renewed focus on increasing tax revenues from corporates may shift the balance towards labor. The outcome of the struggle between capital and labor will depend on wage trends in the context of tight labor markets and sticky inflation. The trade-off between unemployment and wages is typically steeper when trend inflation is rising.

Fiscal authorities versus central banks

Pandemic policies shifted from monetary-led to fiscally-led approaches. Governments providing fiscal stimulus might raise inflation, with strong central banks tempering the impact. A government prioritizing security and climate over fiscal prudence could reinvigorate inflation. Central banks might resist facilitating profligate governments with easy money policies when inflation is above target.

US versus China

Multipolarity is evident with China and the US vying for technological dominance. The peace dividend seems to have disappeared and trade tensions could lower global GDP growth. Western governments aiming to maintain the status quo could mean more regulations, increased military spending, and less laissez-faire economics.

Peter van der Welle, Multi Asset Strategist at Robeco: “The dawn of multipolarity, the rise of labor and the end of monetary leniency are key dynamics to track as an asset allocator. The promise of generative AI has only raised the stakes. The surge in technological capabilities in today’s economy has increased the potential for dispute. In our view, we are entering a power play economy.”

Expected impact for Multi Asset strategies

If these power plays can be managed, Robeco’s base case is for economic stalemate, with a mild recession in 2024 and inflation stabilizing on average around 2.5% towards 2029. A bull case would entail early, widespread adoption of artificial intelligence bringing huge technological progress that delivers a disinflationary supply shock for the global economy. The bear case is for mistrust between the superpowers to usher in low growth and stagflation.

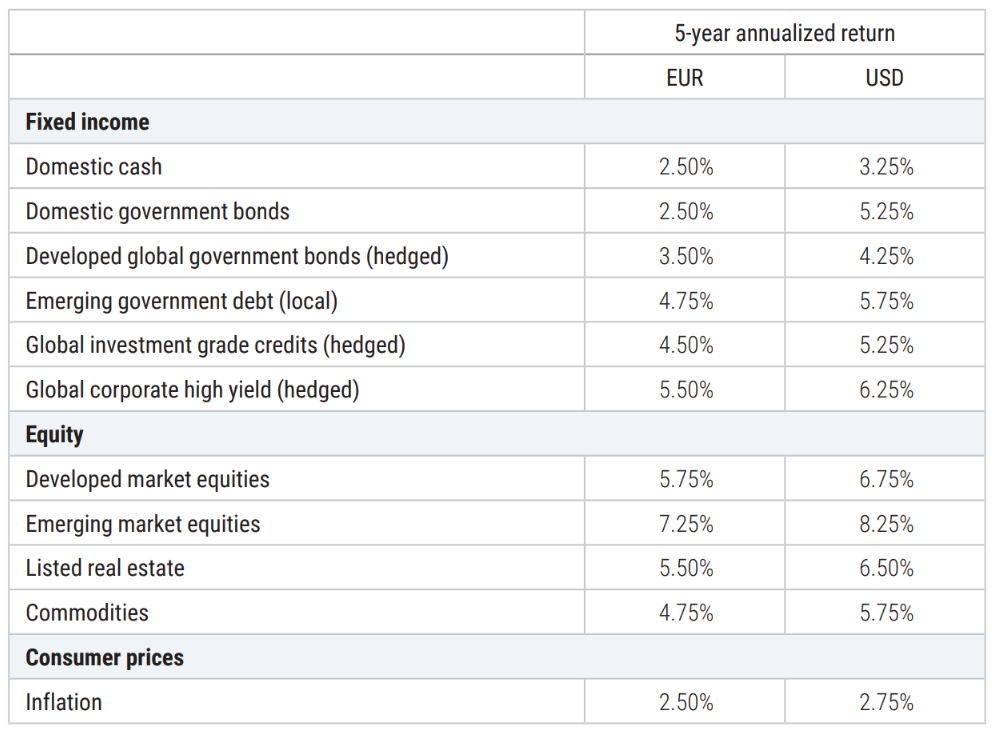

Laurens Swinkels, Head of Quant Strategy, Sustainable Multi Asset Solutions at Robeco: “While the convergence of powerful forces heightens the likelihood of extreme outcomes, it also opens doors to diversified investment strategies that can thrive under various scenarios. We are slowly shifting from a time with low interest rates and high equity risk premiums, to a period with higher interest rates and lower equity risk premiums, as US equities are still expensive. Corporate bonds, on the other hand, are fairly valued and default losses in our base scenario are moderate, leading to close to historical average risk-adjusted returns.”

In the bull scenario ‘AI get wings’, seemingly expensive tech companies can still perform well, and further lift productivity in other industries, leading to 11% expected returns for shareholders. In the bear scenario ’De-risking’, central banks have to fight inflation while governments keep fueling it, leading to lower real growth and therefore even lower returns on risky assets –2.5% per year for equities.

Robeco’s Expected Returns report also focuses on four special topics:

- Using machine learning for emerging market equity returns

- The invisible hand that guides bond markets

- Integrating the SDGs into government bond portfolios

- Finding value within long-term thematic trends