When cash remains king, everyone wins. We assess how using Flagstone’s cash deposit platform can lead to greater value for your clients’ cash – and your business.

The UK economy, past and present

The events of the last few years have left financial markets in a state of flux. War in Europe and the Middle East, the rise of AI, rocketing interest rates and inflation, and a dash of political turmoil have all made their mark. And today, savers are left to navigate the resulting landscape. UK base rates have continued their post-pandemic ascent, rising from an all-time low of 0.1% in March 2020 to 5.25% in August 2023, where they have remained since. As rates hit a level nearly 50 times higher than in 2021, savers piled into cash like a ship looking for a port in a storm.

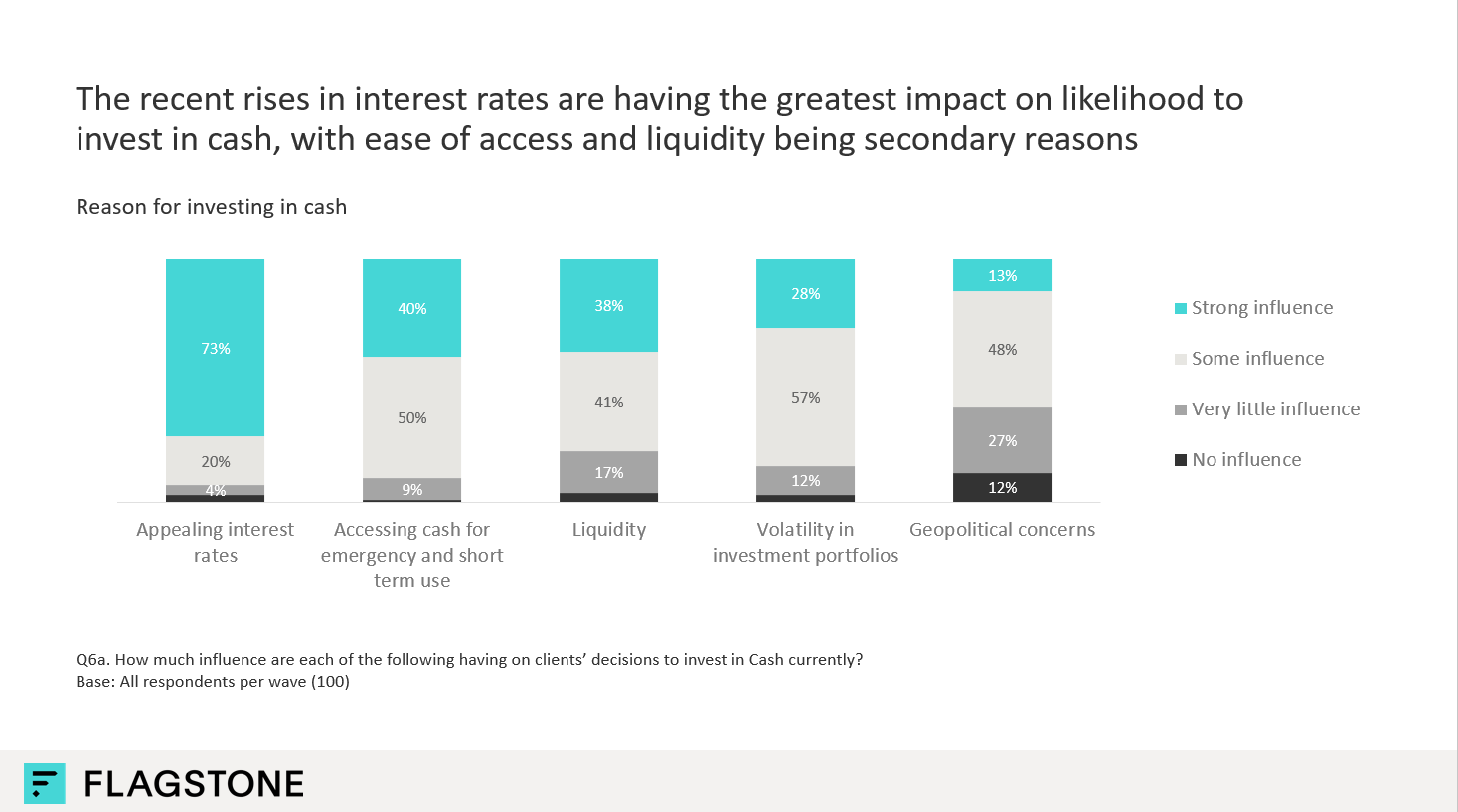

It’s no surprise then that, according to the latest Flagstone survey data, more savers are turning to cash. In fact, 73% of advisers agreed that the recent interest rate rises have encouraged their clients to invest in cash.

While inflation has slowed, and interest rates are rumoured to reduce by the end of 2024, any reduction is still probably going to be nominal. It is likely that interest rates will remain higher than the historical lows we have experienced in recent years. Today, markets foresee that UK interest rates are likely to stabilise at around 4% by the end of 2027. Meanwhile, headline rates on some accounts can now beat inflation for the first time in a long time.

The case for a cash deposit platform

Even with rates at historically high levels, much of clients’ cash still sits idle in low-interest accounts. This is likely a product of inertia from a client’s point of view, and a matter of priorities for advisers. Few advisers would feel that their time (or their clients’) is best spent constantly switching savings accounts.

But cash deposit platforms provide an easy alternative. Whether your clients are individual savers, businesses, or charities, platforms like Flagstone allow them to open and manage multiple savings accounts in one place, with one application. They’re designed to cut out the admin, so clients can easily protect and grow their cash. This makes them perfect for the cash-rich and time-poor.

As the UK’s leading cash deposit platform, Flagstone offers:

• easy access to hundreds of accounts from 60+ banks

• FSCS protection on eligible deposits

• exclusive interest rates

They currently have £11bn in assets under administration, from 600,000 clients, as well as the largest panel of partner banks of any cash deposit platform.

How is Flagstone flying the cash deposit platform flag?

Flagstone is passionate about the role of cash in a well-balanced and diversified investment portfolio. They’re also focused on supporting advisers in educating their clients about the vital role of cash.

There are two reasons why Flagstone clients can now access competitive rates from over 60 banks. The first is volume. As mentioned, they have more than £11bn in assets under administration on the platform, and 600,000 clients. This scale means they can negotiate strong rates for clients.

Secondly, they can save banks money. Once a client opens a new savings account through Flagstone, the bank in question will never need to communicate with that client. They’ll never need to manage AML/KYC, as Flagstone handles this for them. This hands-off approach spares banks the operational and technological costs, meaning they can offer competitive (and at times exclusive) rates as a result.

The role (or roll) of cash

Savvy savers can now earn over 5% gross on their cash deposits, so holding cash is more attractive than it has been in the past. However, there is still inertia around cash, with large amounts left to idle away in high street accounts offering little in the way of interest or rewarding loyalty. More importantly, these savings are losing out against inflation.

The FCA conducted a review of the cash savings market last year, finding nine of the biggest savings providers, on average, had passed on only 28% of the base rate rise to their easy-access deposits between January 2022 and May 2023. In keeping with the new Consumer Duty standards, the FCA stipulated that firms offering the lowest savings rates must justify how those rates offered fair value. In a December update, the regulator said it had seen progress in the speed and size of interest rate changes for savers, with the average rate paid on easy-access deposits in October 2023 up to 1.99% from 0.89% in January 2023.

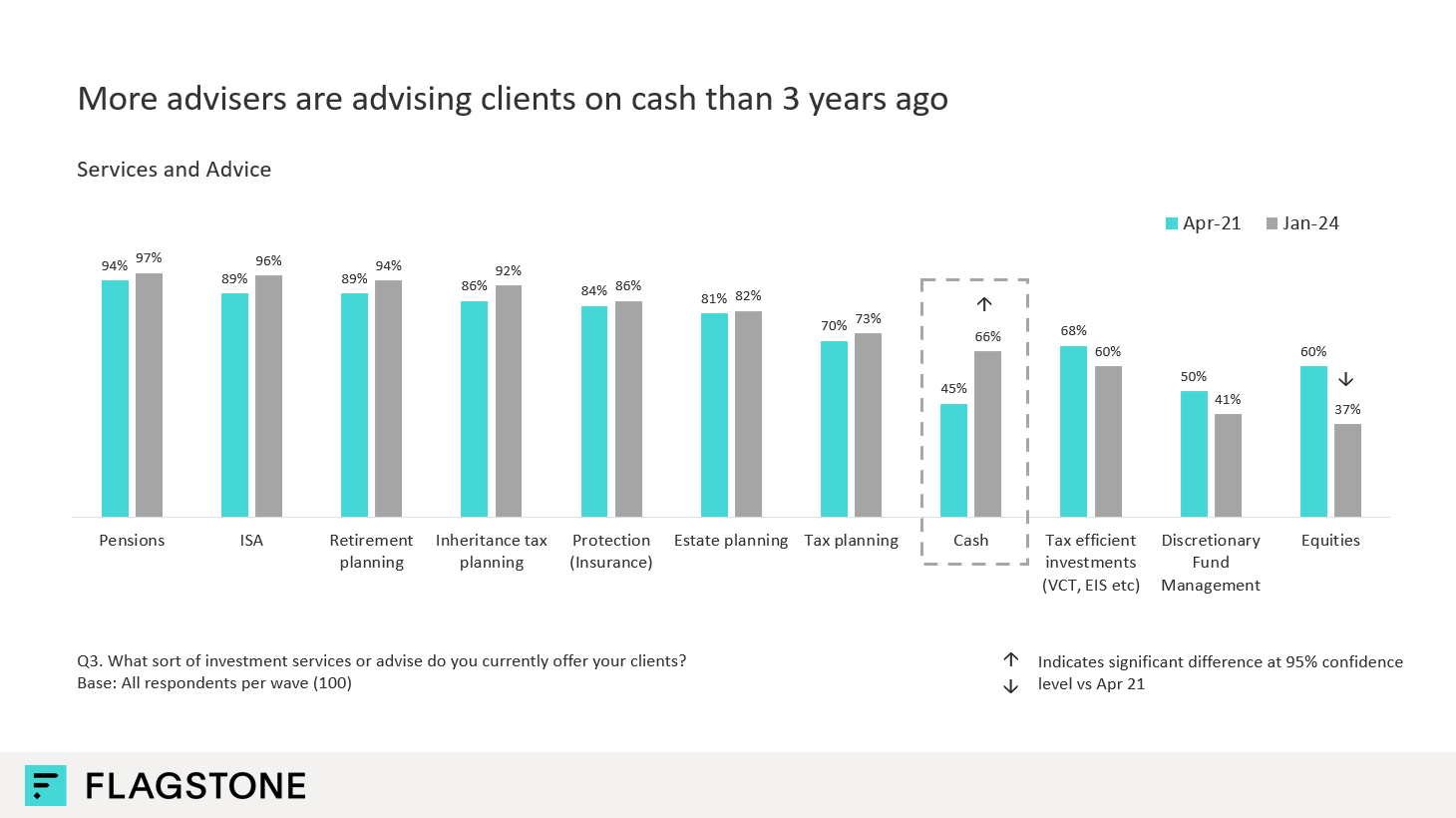

Advisers are clearly placing cash deposits firmly on their agendas, having more conversations with clients, and recognising cash as an integral part of a broader savings and investment portfolio. In a previous Flagstone survey, 66% of advisers said they are advising clients on cash as of January 2024, compared to only 45% in April 2021.

While today’s higher interest rate environment is helping to shift perceptions towards cash, advisers know that managing a client’s overall wealth isn’t solely a matter of maximising returns. It’s also a matter of suitability and balancing risk. Cash offers security that few assets can match, as well as a liquid buffer against unexpected life events and gaps in cash flow.

Are cash deposit platforms the solution to cash inertia?

The Bank of England estimates that UK households currently have £1.7trn in savings. Of that, a staggering £260bn sits in accounts earning savers absolutely no interest. To make it easy for savers, they need a simple, frictionless experience. Which is where cash deposit platforms such as Flagstone come in.

Simon Merchant, Co-Founder and CEO of Flagstone sums it up when he says:

“Cash presents a much greater opportunity these days, but it is being stifled by savers’ inaction in the face of complex bank requirements. Cash deposit platforms are the answer.”

There seems a clear disconnect between the leading interest rates which cash deposit platforms like Flagstone are offering and the general inertia seen in connection with deposits in bank accounts. The process of searching for suitable accounts, opening accounts, and moving money is laborious and time-consuming. Bank applications, paperwork, passwords, and ID checks put a lot of people off.

And with new rates being launched every week, it’s nearly impossible to keep up with the changing market. A cash deposit platform provider, such as Flagstone, works with banks and building societies to bring together a wide selection of savings accounts. This allows the user to pick and choose without having to apply directly to each bank. They simply fill in their details once to gain access to all available accounts.

In that way, a cash deposit platform can offer not only competitive interest rates but also important flexibility, security, and transparency too.

Advisers are becoming more aware of cash deposit platforms as part of their client’s financial planning, but it seems that they are still severely underutilised. The recent Flagstone brand tracking survey found that only one-fifth of all advisers are advising on cash using a cash management platform.

The holistic view of an individual’s cash strategy afforded by cash deposit platforms ultimately allows them greater flexibility and peace of mind. Advisers cannot afford to overlook a robust strategy for this inevitable asset class.

And, by using cash deposit platforms like Flagstone, advisers can easily ensure that their clients never keep more than £85,000 in a single savings account. Instead, they can effortlessly spread deposits across multiple banking groups, and maximise their clients’ FSCS protection, as well as their interest. After all, when cash remains king, everyone wins.

Smart saving, surprisingly simple. For more information, visit the Flagstone website.