Gold’s ongoing run of new record prices has seen the number of first-time precious metals investors double ahead of the US election, according to data and analysis from world-leading precious metals marketplace BullionVault.

New buying in the USA was softer, however, slipping last month from September’s figure.

“If the US election is having any impact on safe-haven demand for bullion, it’s spooking private investors in Europe far more than American voters right now,” says BullionVault director of research Adrian Ash.

“It’s hard to imagine that gold has lost its protective appeal among US investors. America’s relatively soft demand for precious metals perhaps signals the depths of political polarisation. Voters are so divided, they don’t know and rarely meet anyone with opposing views, so they believe a big win is coming for their chosen candidate.”

Gold priced in British Pounds set its 5th new record month-end price in a row in October, rising 8.0% to £2122 and recording its 40th fresh daily high of 2024 to date at £2153 per Troy ounce last Wednesday. That count already matches the full-year record of 1979, and 14 of gold’s new highs in 2024 came in October, the most ever in one calendar month.

Worldwide, the number of new investors in precious metals doubled from its prior 12-month average (+104.2%), jumping 49.9% from September’s figure to mark the most first-time users of BullionVault since March 2022 – the Russian invasion of Ukraine – on a surge in the UK, France, Germany and Italy.

UK first-time investors rose 41.6% from September and 116.2% from the prior 12-month average amid concerns over Rachel Reeves’ first Labour Budget, reaching the most since May 2021. But despite the impending White House election, and while the number of first-time investors in the USA held 54.8% above its prior 12-month average, it dropped 17.2% from September’s figure and was 36.8% below May’s 13-month high.

Last month, the number of people starting or adding to their personal gold holdings using BullionVault rose to the most since June 2023, up 37.5% from September, while the number of investors choosing to sell rose 9.3% to the most since April.

Together, that took the Gold Investor Index – a unique measure of physical bullion sentiment across the past 15 years among the world’s largest pool of private investors in precious metals – 1.6 points higher from September’s 5-month low to 53.6, the highest reading since June.

The Gold Investor index set a decade-high of 65.9 as the Covid Crisis hit in March 2020, and it fell to an all-time low of 47.5 this March as gold began its current price surge, signalling more sellers than buyers with only its 3rd reading below 50.0 of the past 15 years.

“Gold’s record-breaking bull market has clearly pulled in speculative traders betting that these price gains will continue. But it would be wrong in physical bullion to attribute this jump in new buyers solely to fear-of-missing-out.

“Uncertainty, volatility and geopolitical risks are rising, and not just because of the US election. Gold has repeatedly helped offset losses in other asset classes, and that appeal is starting to overcome the sticker shock of gold’s latest all-time highs. For new investors, the price you missed doesn’t matter. What counts for today’s buyers is what gold’s track record says it could do when the next crisis strikes.”

By weight, gold investors were net sellers yet again as a group overall in October, with BullionVault client holdings – all vaulted and insured in each user’s choice of London, New York, Singapore, Toronto or Zurich – shrinking 0.6% to a 51-month low beneath 44.2 tonnes.

That marked the 14th consecutive month of investor profit-taking overall. But the net quantity of 271 kilograms sold was smaller by almost a quarter (23.2%) from September’s 6-month record. October also marked the 4th month in a row that BullionVault clients’ gold holdings grew to a fresh month-end record, rising 7.4% to £3.0 billion.

While client gold holdings have now fallen 8.4% by weight since August 2023’s all-time record above 48.2 tonnes, the value has risen 26.9% in British Pound terms.

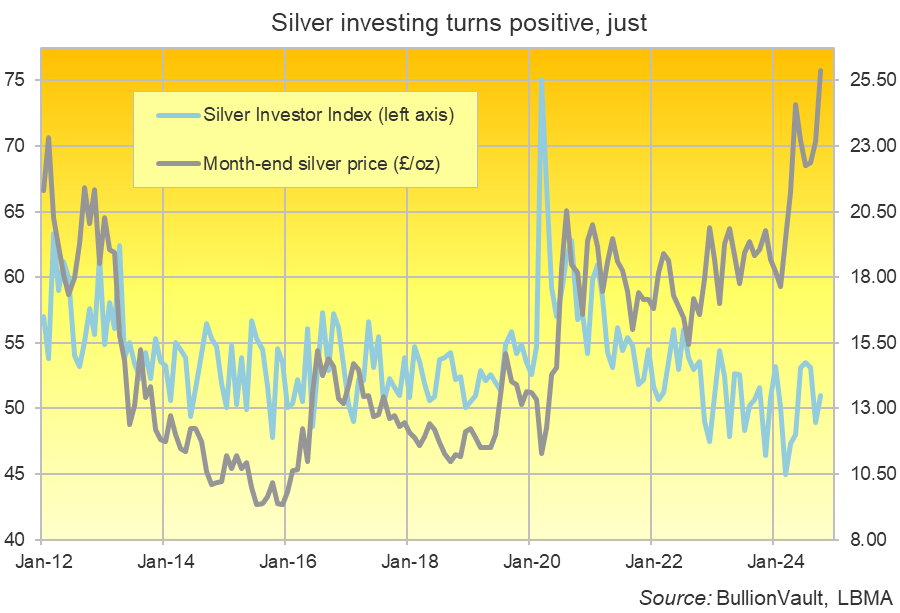

Private investors in Western Europe and North America – where BullionVault finds 9-in-10 of its users worldwide – were also net sellers of silver by weight in October, liquidating 16.4 tonnes of the more industrially-useful precious metal.

That 1.4% drop more than erased the summer’s rebound in BullionVault clients’ silver holdings, cutting them to the lowest in 45 months at 1,146 tonnes. But while investor silver holdings have now shrunk 9.5% from October 2022’s record high above 1,267 tonnes, the value has risen 41.2% to a record £954 million.

The number of silver buyers worldwide meantime leapt by 66.4% from September’s 6-month low, while the number of sellers continued to rise but less quickly, adding 17.6% to hit the most since May.

Together that pulled the Silver Investor Index up 2.1 points from September’s 4-month low to read 51.0, marking only the 6th month of more buyers than sellers so far this year.

Silver prices rose 11.7% across October – the 3rd double-digit gain of 2024 so far for UK investors – peaking at £26.85 and setting the highest month-end since April 2011.