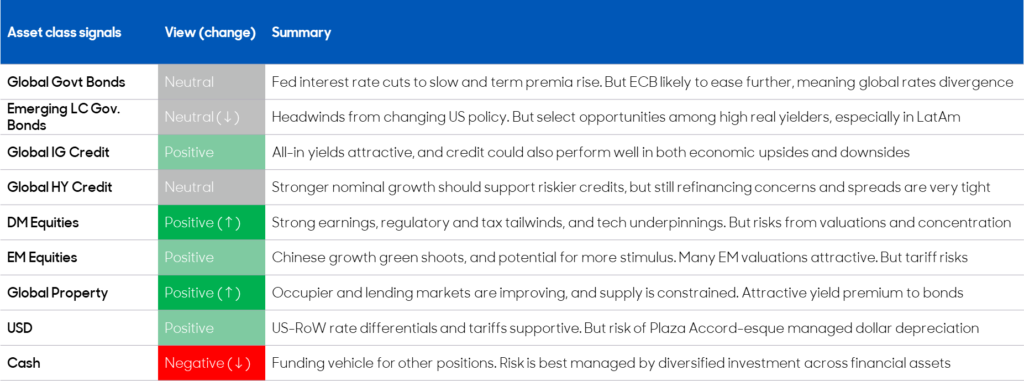

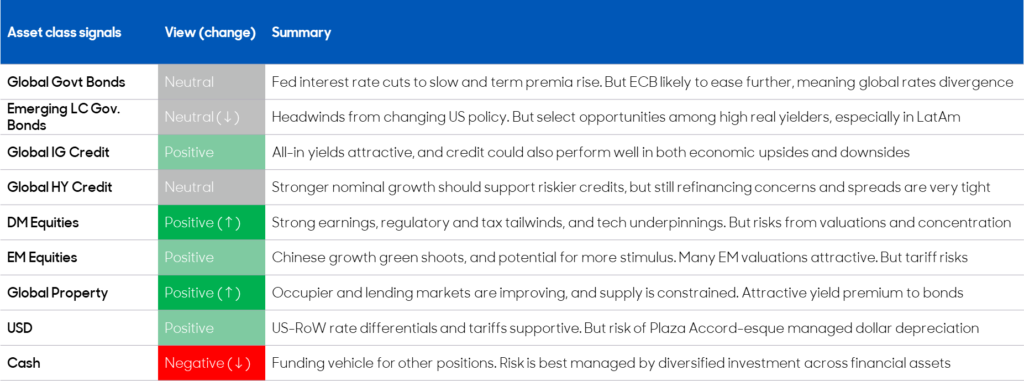

Despite uncertainties around policy shifts, abrdn is positive on US and developed markets equities, selective Emerging Markets, while real estate is upgraded for third quarter in a row

- Elevated US equity valuations bring risks, yet these are judged as justified by earnings strength, tech fundamentals, and forthcoming shifts in US tax and regulation policy.

- Further policy easing is likely in China, so despite headwinds, the House View is modestly positive on EM equities.

- Neutral on most fixed income markets, with divergence a key them – Emerging Market debt downgraded

Global asset manager abrdn has published its latest quarterly ‘House View’ on the macro-economy and investment outlook. Much centres around the US and the course of ‘Trump 2.0.’

The House View has become more positive on developed market equities, with strong US earnings growth, and a likely broadening in tech and AI winners, providing a fundamental basis for stock market performance. However, elevated US equity valuations bring risks, with the valuation gap between US and European stocks now at a record high. This keeps positioning sizing still relatively small.

Overall, abrdn is positive on corporate risk and the dollar, positive on real estate, and neutral on most fixed income markets, with divergence a key theme. The House View thinks investors are better off taking diversified risk in financial markets, rather than sitting in cash.

A stronger dollar and global trade uncertainty are likely to be headwinds to emerging market debt, which has been downgraded. But the House View stresses that there can be emerging market winners in the changing patterns of globalisation, with select opportunities especially among higher yielding countries in Latin America.

There are several risks to this outlook, including from US trade, immigration, and fiscal policy; Chinese growth and the stimulus response; and various political and geopolitical flashpoints.

Peter Branner, Chief Investment Officer, abrdn, says:

“Moving into 2025 there is significant uncertainty about the precise contours of the coming policy shifts under president-elect Donald Trump. There is a substantial risk that the Trump administration proves much more disruptive than we are expecting, both to the upside and downside in terms of economic and market outcomes. And there are scenarios in which Trump’s policy agenda proves even more supportive for growth and market sentiment.

We expect continued strong US GDP growth in 2025 driven by a cooling but still solid labour market and strong corporate profitability, and slightly stronger growth in 2026 boosted by tax cuts and deregulation.

Against this backdrop, we’re positive on developed market equities as the outlook for US earnings growth remains strong, and we continue to upgrade our positive position on property as the market turns up from the bottom of the cycle. We are modestly positive on emerging markets in anticipation of more China stimulus and have identified opportunities in select emerging markets that can benefit from shifting patterns of globalisation.”

Small caps

Forthcoming shifts in US policy bring uncertainty, but are likely to disproportionately benefit US firms, and small caps in particular. The deregulation agenda pursued by the Trump administration is likely to see the Federal Trade Commission make M&A activity easier, while relaxing bank capital regulations and granting more energy exploration permits. Corporate tax cuts will tend to benefit smaller companies most, while by contrast tariffs will disproportionately hit internationally exposed firms.

Emerging Markets

Across the emerging markets complex, there can be both winners and losers from US trade policy. In fact, some of the most vulnerable countries – such as Mexico and Vietnam – are also best placed to gain from reshoring if the US does pursue rapid decoupling from China.

Chinese growth does appear to be recovering somewhat heading into 2025, and further policy easing is likely. With valuations low, the asset class provides an attractive option on the possibility of China delivering significantly more policy easing. abrdn thinks further easing is necessary to offset both internal headwinds from the property sector and low inflation and external headwinds from US trade policy.

A stronger dollar and global trade uncertainty are likely to be headwinds to emerging market debt, slowing the pace of EM rate cuts even as inflation is gradually returning to target. As such, abrdn has downgraded its signal on the asset class, moving to a neutral stance.

Real Estate

abrdn has further upgraded its positive signal on global direct property for the third quarter in a row. Pricing, rental, and activity data suggest the market is now turning up from the bottom of its cycle, which historically provides a good buying opportunity. The yield premium above fixed income looks particularly attractive. Rental growth is expected to be remain solid, especially in the US, with supply growth having been weak, while improving market liquidity is helping to boost investor sentiment towards the asset class.

Macro

In 2025, abrdn expects continued strong US GDP growth driven by a cooling but still solid labour market and strong corporate profitability. Tax cuts should be a tailwind for growth in 2026, but the negative impact of immigration and deportation measures are likely to build over the more medium term. The combination of stronger aggregate demand and a negative supply hit means US inflation is likely to be higher than previously expected, with core PCE inflation stuck around 2.5% for the next few years.

Therefore, abrdn’s House View expects the Fed to cut only three times in 2025, leaving rates at a higher plateau of 3.5-3.75% and developed market interest rates to diverge over the next few years. While the Fed is likely to cut by less than previously expected, the European Central Bank is likely to cut more aggressively because of trade uncertainty and the EU’s underlying economic weakness.