Global asset manager abrdn has published its latest quarterly ‘House View’ on the macro-economy and investment outlook for Q4.

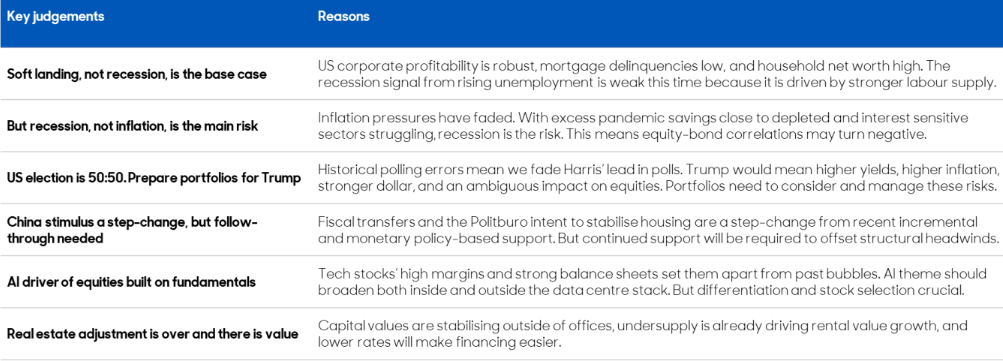

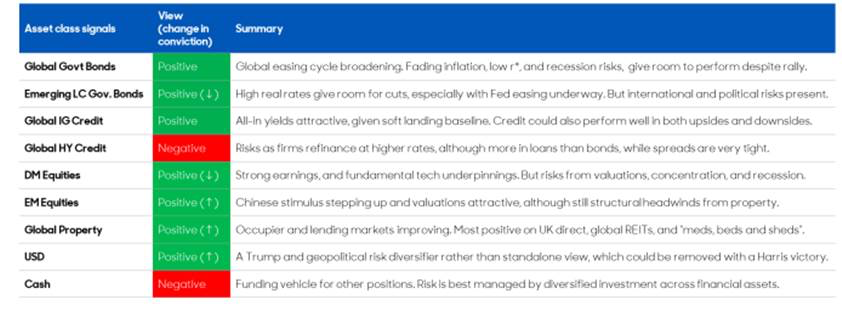

Overall, abrdn remains positive on equities and bonds given monetary easing and an expected ‘soft landing’, but has become tactically overweight the dollar to hedge against the US election outcome and geopolitical risk.

Spiking tensions in the Middle East are a risk to the outlook, but oil prices would have to rise by a lot to prevent central banks cutting interest rates further.

Meanwhile, as the US presidential election looks set to hang on a very small margin, with a 50% chance of a Trump victory, abrdn sees potential for trade and fiscal policies that could be inflationary.

However, it is recession, rather than inflation, which abrdn sees as the bigger risk for markets over the medium term, whoever ends up in the White House.

The House View sees ongoing fundamental support to corporate earnings, and a benefit in holding duration. But as the prevailing macro environment moves from one characterised by negative supply shocks to potential negative growth shocks, bonds and equities ought to move from being positively correlated to negatively correlated, providing natural diversification. This has been the case in recent months, with duration performing during equity market corrections.

Peter Branner, Chief Investments Officer, abrdn, says: “Geopolitical uncertainty will shape this quarter and beyond with several major risks to our main scenario. One is further conflict escalation in the Middle East that sends oil prices and geopolitical risk premia substantially higher. Another is a risk of US-led recession. However, looking through the risks, we forecast cooling yet still positive US growth, inflation around central bank targets, a global rate cutting cycle, and a tentative view that Chinese stimulus is step-shifting higher. In terms of opportunities, whilst both equities and bonds have done well so far this year, we see ongoing fundamental support to corporate earnings, and benefit in holding duration given the risks. There are bright spots in real estate, and we’re tactically overweight the US dollar as we see the US election as 50:50.”

Equities

A proactive approach to monetary easing and the materialisation of a soft landing should support corporate risk. The recent earnings season saw positive revisions, and a broadening out of earnings growth to cyclical sectors should support prices. While US equity valuations are elevated, the House View thinks that tech stocks’ high margins, high free cash flow generation, and strong balance sheets set them apart from past bubbles.

abrdn has also shifted to signal a modestly positive view on emerging market (EM) equities. There has been a step change in the extent of Chinese policy easing which could lead to a significant repricing higher of Chinese equities. However, sustained support will be required to offset structural headwinds from real estate.

Bonds

The House View remains positive on duration, signalled via an overweight to global government bonds and to Emerging Markets local currency bonds. However, reflecting the extent of the rally in duration markets and Emerging Markets currencies, and risks from a Trump presidency, the Emerging Markets local bond conviction was lowered.

With interest rates having moved over the last quarter it could be that duration is a tactical neutral at this point. But with recession risks elevated over the House View’s 12 to 18-month horizon, it is sensible to hold some duration.

Real Estate

abrdn has upgraded its view on direct global real estate to positive and finds listed real estate, geographies such as the UK and Europe, and sectors such as residential, hotels, student accommodation, data centres, and logistics most attractive.

There has been a deep valuation correction across global real estate markets, especially in the UK and Europe, and in the office sector. However, this process now looks largely complete. The yield premium on real estate, especially as policy rates are being cut, is attracting capital back into the sector. And constrained supply is supporting rental value growth as occupiers consolidate into future-fit properties.

abrdn recognises that the US election is a key risk to the global economy and has analysed various US election scenarios to try to understand how different election results could impact asset prices and portfolios.

As a result, the House View has become tactically overweight the dollar in the run-up to the US election. In the soft-landing base case for the economy, the House View expects the dollar to modestly depreciate over the medium term. But in the event of a Trump victory, the dollar would likely appreciate and hedge losses on other positions.

Macro

The House View expects a global economic soft landing and has become less concerned with the risks of an inflation overshoot generated by low unemployment and strong wage growth.

There are certainly still several sources of upside global inflation risk, including a sharp rise in oil prices and disruptions to global supply chains related to spiking tensions in the Middle East.

But despite the soft-landing baseline, the House View notes that the US economy is slowing, with interest rate-sensitive sectors such as manufacturing and housing struggling, and the fiscal impulse fading. It is possible that this slowdown morphs into a more damaging contraction.

This economic backdrop explains why the House View is expecting a sustained global interest rate cutting cycle and continues to judge that global equilibrium interest rates remain relatively low, around 2-3% in nominal terms. While there is significant uncertainty around this judgement, many of the structural factors that pinned equilibrium rates down before the onset of the pandemic are still broadly in place. The recent sharp slowing in nominal growth also suggests that the stance of policy has been tight. As such, the global rate cutting cycle has significant room to run before interest rates return to a more neutral setting, let alone a stimulative stance.