Gabriella Dickens, G7 economist at AXA Investment Managers, comments on the UK General Election:

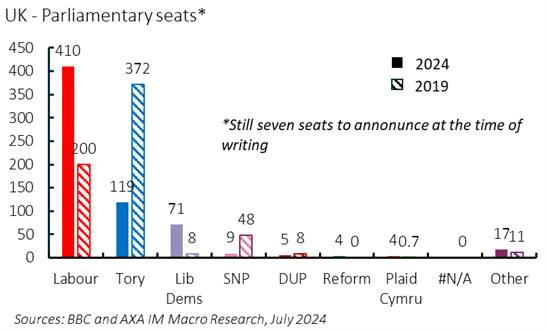

• Keir Starmer is the new UK Prime Minister and is currently on track to form the new Parliament with a majority of around 170 (7 seats still are to declare at the time of writing). That is far larger than the Conservatives’ majority in 2019, 80, though the story is largely one of Conservative weakness, rather than Labour strength.

• The coming weeks will be busy, with a NATO meeting next week and then the King’s Speech the week after. We doubt there will be anything new delivered, instead the new PM will likely push ahead with legislation towards achieving his five key “missions”. The Autumn Budget – likely to be held in early October – will be the first event showing the priorities of the new government.

• This will be where reality hits; the IFS have highlighted numerous times during the election campaign the strained nature of the public finances. We think additional fiscal tightening will be needed over the next five years.

The polls were right; Keir Starmer will step into No. 10 Downing Street later today as the UK’s new Prime Minister (PM) after 14 years of Conservative government. The Exit Poll predicted Labour would win 410 seats – slightly less than former PM Tony Blair’s showing in 1997, 419 – and at the time of writing, Labour looks set to win a slightly higher 413 (with still seven seats to go). If that bears out, Labour will lead with a majority of around 170, far larger than the Tories’ in 2019, 80. A prominent boon to the Labour Party was the revival of their vote in Scotland; the party picked up 36 seats, following the collapse of the Scottish National Party (SNP), which won just 9 seats, down 38, but more importantly the split of the right vote.

The Conservatives, by contrast, faced a wash out with a staggering 19% drop in vote share from the last election. At the time of writing this looks to translate to a win of just 122 seats, 243 less than in 2019, which would result in a larger swing than in 1906 when Arthur Balfour’s government lost 211. Key Tory losses included a future favourite for leader Penny Mordaunt, Jacob Rees Mogg, former PM Liz Truss, Liam Fox, and Grant Shapps. The party’s performance was not quite as poor as some had expected – The Economist, for instance, had predicted that the party would win just 76 seats and the lowest MRP poll 56. But there are no two ways about it, this was a bad day for the Tories and means Rishi Sunak will most likely step down as the leader of the Conservative Party, sparking another Tory leadership race – Kemi Badenoch and James Cleverly are among the current favourites to succeed him.

|

Exhibit 2: …But the Party’s vote share has barely risen

|

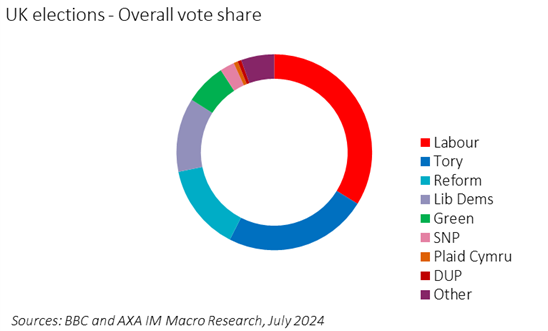

It was also eighth-time lucky for Nigel Farage, meanwhile, who will now become an MP, having won in the Clacton-on-Sea constituency in Essex with 46.2% of the vote. More broadly, though, Reform UK will not hold much sway in parliament, with the party failing to translate a huge increase in the popular vote (at 14.3%, up 12.3ppt) into seats. Indeed, the first-past-the-post (FPTP) system means the party is on track to win just 4 seats, less then the 13 the Exit Poll predicted.

The Liberal Democrats, however, had their best showing in over a century. Indeed, the party looks set to increase their seat share by 63, leaving them with 71 seats overall, the largest number in a century. This is another quirk of the FPTP system, with their popular vote share up just 0.6% to 12.2% – less than for Reform. However, the party is now the third largest in parliament, despite polling behind the Reform party over the past few weeks. Wells & Mendip Hills, Chichester, Dorking & Horley, Wimbledon, Yeovil, Hampshire North East and Norfolk North were just some of the constituencies won from the Tories.

Despite the significant swing in the number of seats, the story is one of a Conservative loss rather than Labour gain. Indeed Labour’s vote share has only risen by 1.6% to 33.8%, with the vote split on the right, the collapse of the SNP (seats falling to 9, down 38) and tactical campaigning alongside the Lib Dems underpinning Labour’s victory.

Yet more broadly this election reflects a greater fluidity of votes across and parties. The Conservative share collapsed to 23.7%, from 43.6% (-19.9%), but Reform UK picked up 14.3% and around two-thirds of the Tory seat losses in England reflected a split vote with Reform. The vote share does imply a genuine shift to the left, however, with the combined popular vote share for Labour, the Lib Dems and Green up 6% – most reflecting a 4% increase in support for the Green Party – whereas, combined, the Conservatives and Reform UK were down 7.6% from 2019 (the difference being made up by a 1.4% increase for independents, particularly reflecting the impact of things like Gaza in some jurisdictions, for example in Leicester).

This election also marks a warning for the political system, a large majority has been delivered on a little more than a third of the popular vote. Moreover voter turnout was just 60% at this election (only lower in 2001 since 1918), down 7.6% from 2019 suggesting a broader political disconnect.

The scale of Labour’s majority is as much an outcome of the peculiarities of our voting system and an interplay of split votes and the SNP, rather than of a resurgence in Labour’s popularity. However, the popular vote has shifted to the left more generally. If the Labour government can govern over the next five years and deliver a recovery in economic growth, investment and individuals real incomes they should be well placed for to see a genuine improvement in the future.

Muted reaction in the markets, so far

The consistent chunky 20-point lead of Labour in the polls over the last 18 months or so means the reaction has been fairly muted. Sterling – the only asset open to trading overnight – has held broadly steady; the currency is UNCH against the euro and although 0.1% stronger against the dollar, that reflects a 0.1% drop in trade-weighted dollar, rather than sterling strength. Yields are also broadly steady; 2-year and 10-year gilts -2bps to 6.16% and 4.17% respectively. The FTSE 100 has started trading 0.4% higher.

What next?

Later today, Rishi Sunak will tender his resignation as Prime Minister after which Keir Starmer will visit Buckingham Palace and ask the King for his permission to form a government. We then expect Mr. Starmer to travel to Downing Street where he will deliver a speech to the nation before meeting the staff of No. 10 and laying out plans for his new cabinet. Key positions will likely include Rachel Reeves as Chancellor, Angela Rayner as Deputy Leader and Secretary for Levelling Up, Yvette Cooper as Home Secretary, Wes Streeting as Health Secretary and Shabana Mahmood as Justice Secretary.

The new PM will have little time to get used to the new job before jumping into the deep end. Keir Starmer is due to attend a three-day NATO meeting next week before opening the new parliamentary session with the King’s Speech on 17TH July (note the new government can alter this date if it deems necessary).

We don’t think there will be anything too surprising in the King’s Speech; Labour has long highlighted the five key “missions” it intends to prioritise on entering government – economic growth, the green energy transition, the criminal justice system, the NHS and breaking down barriers to opportunity. It will signal its intentions to push through legislation in this vein over the first 100 days, but we will watch for any surprise announcements over the course of the coming days.

On the economic front, the new Labour government will start by showing its commitment to a more stable business environment by reaffirming the party’s support for key institutions: central bank independence and strengthening the independence of the Office for Budget Responsibility. Indeed, the new government intends to make it possible for the fiscal watchdog to independently publish forecasts for any fiscal event involving tax and spending changes, to prevent another instance of the turmoil caused by Liz Truss’ mini budget.

The party will also start to lay out a path for business taxes which it committed to in the manifesto, which the new leader will likely mention.

An additional focus in the Labour manifesto was its intention to boost housebuilding by an additional 300K houses a year. In this regard, the new leader will use this speech to outline the party’s plans to start to usher in a top-down approach, pushing through planning reforms, such as removing “hope value” for land speculators. He will also likely pledge to push ahead with other supply side measures including the plan to ‘make work pay’. This will include measures to crack down on zero-hours contracts and hire-and-fire practices, setting up collective bargaining for the social care sector and extending equal pay protections to ethnic minority and disabled workers. The PM will also outline plans to get NHS waiting lists down and cutting waiting times. Both of these policies should help to boost labour participation at the margin. The new PM will also want to outline the initial stages of setting up GB Energy, a new state-owned energy investor which will provide backing to renewable energy and nuclear projects.

The speech will also likely include several off-the-shelf policies. For instance, the bill on tobacco and vapes which Rishi Sunak failed to get through prior to calling the snap election. He will also likely outline intentions to set up the Office for Value for Money; scrap the controversial Rwanda policy; introduce plans to bring the rail network gradually back into public ownership; and lay out its intentions to create a defence and security pact with the EU.

None of this is new and reflects what the government has been campaigning on. The first real insight into the new Labour government will likely be in the Autumn, with the delivery of the first Budget of the new parliament. Given Labour’s commitment to the OBR and its requirement for 10-weeks notice to prepare for a fiscal event, we expect an announcement within days of the date of this budget and for it to be held immediately after the party conferences in early October.

The fiscal reality

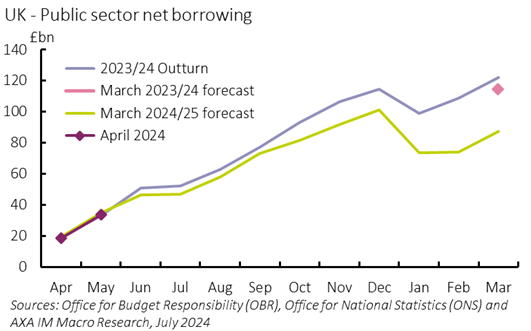

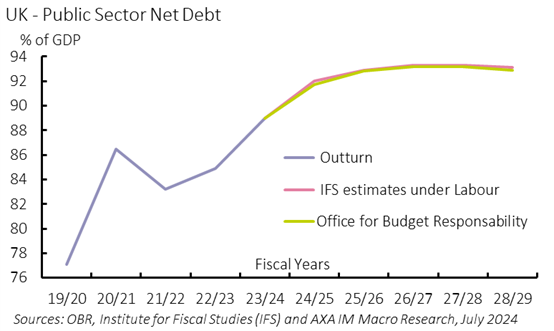

This is where the reality will likely hit and we will start to understand the priorities of the new government. As highlighted by the Institute of Fiscal Studies, the fiscal backdrop awaiting the new government is strained. In line with Jeremy Hunt’s fiscal rules, the incoming Chancellor, Rachel Reeves, has committed to get debt as a share of GDP falling in five years’ time – itself the weakest fiscal constraint since the UK adopted fiscal rules in 1997. Given the high levels of public sector debt, elevated interest rates and sluggish growth, this will be a major constraint on the plans of the new government. Indeed, projections made by the OBR in March alongside the Spring Budget showed headroom of just £8.9bn, well below historical norms. And much of this will probably be wiped out in the Autumn, all else equal, given the infected blood scandal and other forecast adjustments. Indeed, public sector borrowing overshot OBR forecasts last year and will most likely do so again this year.

Exhibit 3: Borrowing will probably overshoot OBR forecast |

|

In addition, to keep the debt-to-GDP ratio falling at the end of the forecast window while cutting taxes in the run-up to the election, the previous government had pushed severe spending cuts into this Parliament. Indeed, the IFS estimates that under current spending plans, unprotected departmental spending – i.e. spending on the criminal justice system and local governments – will be cut by 3.3% per year in real terms. This doesn’t take into consideration the Spending Review – a process where government department budgets are forged – a date for which is also likely to be set in the near future for the Autumn which historically has led to a top up in the departmental resource spending envelope of around £10bn-£20bn, as governments are faced with the realities of setting departmental spending budgets.

Exhibit 4: Labour commit to falling debt-to-GDP in 5y time |

|

Mitigating these developments somewhat, the new government will benefit from some additional fiscal space in the Autumn from stronger-than-expected growth in the near term. The rolling forward of the forecast window to include FY 29/30 will also help at the margin, creating an additional £5bn of fiscal space.

The big picture, however, is that an update of the OBR’s projections is likely to suggest that additional fiscal tightening will be needed, either through tax hikes or spending cuts. This will not be a surprise: the IFS have been shouting about this throughout the election campaign. But we will be interested to know how the government will adjust to this official ‘revelation’

Our own view is that while being forced into additional fiscal tightening risks being politically unpopular, now is a perfect time for fiscal tightening. Unlike Osbourne’s austerity in the 2010s additional fiscal tightening need not hamper growth with monetary policy able to offset the headwind of tighter fiscal policy. Interest rates are currently at a 14-year high – compared to at their effective floor over a decade ago. This would not only support deficit reduction, which become self defeating if it derails economic growth, but the public finances will get an additional boost as rates come down, quickly feeding through to lower government debt interest costs thanks to the way losses on the Asset Purchase Facility are offset by transfers from the Treasury. Read our General Election Preview for more detail.

An island of calm in the storm?

More generally, in returning a broadly centrist government with a large majority the UK should benefit from a period of political stability after nearly a decade of turmoil and upheaval. Indeed it is rare for such a large majority as Labour has gained to be overturned after just one parliament, which could mean a period of stability even beyond the five years of this Parliament. Accordingly, today’s results passed relatively quietly both in the global press and markets, with Sunday’s French elections and the looming US Presidential election debate fallout dominating headlines. By contrast, the UK appears, for the first time in a while, bright compared to its peers.

Boring is not a bad thing for economies. In particular, Labour’s commitment to creating a stable business environment should encourage capital expenditure domestically and invite additional investment from abroad, as firms feel comfortable that the landscape will remain broadly constant, after a period of chaotic external relations and cancelled domestic plans. Stronger investment, alongside broader supply-side reforms should spur productivity growth and help improve living standards.

[1] UK General Elections: A one horse race to Number 10. |

| Exhibit 5: Sterling rise likely reflects global reappraisal |

|

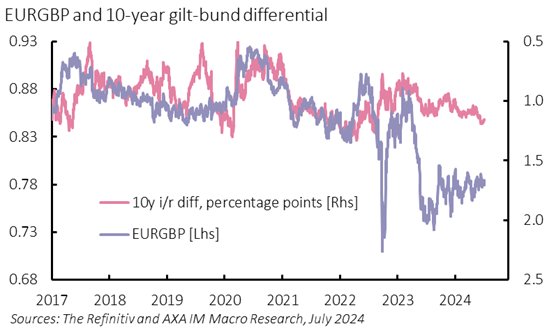

Indeed, there is some suggestion that this process may already be underway with today’s result widely anticipated. Sterling has outperformed broadly stable interest rate differentials (Exhibit 6) for most of the last year, suggesting other drivers of capital, inward investment directed either from increased foreign direct investment or portfolio flows associated with an increase in the UK’s global asset allocation weighting, which was slashed post-Brexit. Indeed, following the 1997 election, sterling held on to sharp appreciation (trading between £0.68 and £0.70 to the euro), despite interest rate fundamentals pointing to depreciation. A recovery in external investment in the UK would be a material tail-wind for growth and an unseen boon for the new government. At the margin, if sterling remains supported by any such inflows it may also tip the Bank of England towards an overall easier outlook for monetary policy over the medium-term.