The wealth management industry is focused on shifting towards a data-driven landscape, exploring new ways to gather, analyse, and utilise customer information. However, despite the industry’s best efforts, progress will be slowed without customer buy-in. Recent customer feedback has indicated that customers are reluctant to provide their data to wealth firms and have concerns about how their data is being used. If wealth management firms want to increase customer data sharing, they should prioritise building trust with their customers by creating a transparent data-sharing environment.

There are three key ways in which to build trust with customers and encourage more data sharing:

- Involve customers in understanding how their data is used and, importantly, how it is not used.

- Simplify opt-in/out mechanisms: clarify what customers are opting into and the benefits of doing so.

- Adopt a personable and engaging approach to reconnect customers with their data.

Here, we will discuss our reasoning, customer opinions, and findings in greater depth.

Tackling Distrust in the Industry

In today’s world, data is king, and financial institutions rely heavily on customer data to improve and personalise services, catering to their customers’ needs. However, in a survey we found that 58% of respondents expressed discomfort with their wealth providers accessing their financial data. Although there could be various reasons behind this hesitancy, our conversations with respondents suggest that many people have negative feelings towards the industry due to the lasting impact of several economic crises over the years.

To gain the trust of their customers, firms can do more to help them understand how regulatory and sector reforms benefit them. For each product, firms can draw attention to the individual protection measures from regulations such as Consumer Duty, Solvency II, and CASS. Many customers find it difficult to understand the benefits of these changes, so it’s important to show them how they translate into clear and tangible advantages. By making these measures more visible and explaining how they apply to each product, customers can feel more confident about the levels of protection in place.

The Rise of Customer Scepticism

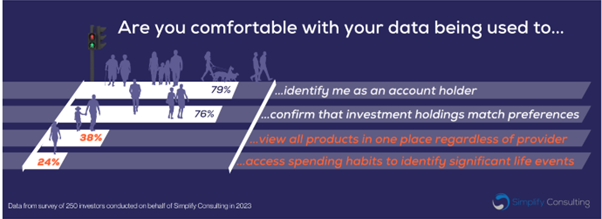

When we dig deeper into the customer data, we can see that the respondents are comfortable with only low levels of data sharing. Only 24% of respondents are content with firms tracking their spending habits (Figure 1). Delving into customer opinion, data tracking is widely viewed as a violation of privacy among our focus group. Moreover, there is a perception that data collection is primarily for targeted advertising, possibly influenced by their experiences in other industries.

Figure 1: Graph showing to what extent customers are willing to share their data

Our focus group discussed how important it is for firms to be transparent about how they use data and make it easier for customers to control their data usage.

Firms could use simple opt-in/out mechanisms accompanied by summaries that explain how the data is used, how it is not and, importantly, the benefits of sharing data. This would help customers make informed decisions rather than automatically choosing not to share their data.

If firms can improve customers’ confidence in data sharing, they can offer more targeted products and services. This means that customers will receive product information that is more relevant to their interests and reduce the amount of “junk mail” they receive. As a result, customers will be more likely to engage with targeted communications, and firms will see an increase in click-through rates.

Product Personalisation

Without customer buy-in, we may see challenges with new products and services under development built around data sharing, such as the Pension Dashboard. Wealth firms must shift consumer perceptions and build on positive experiences. Firms can look at how this challenge is tackled in the wider financial services industry. For example, Monzo customers can access a synopsis of their spending habits through a humorous graphic, sparking conversations and shares.2 This approach resonates with the younger users and encourages them to engage with their finances. Wealth firms could adopt a similar personable approach to persuade more customers to consent to further data sharing.

New solutions

Acknowledging the challenges that wealth firms face in using data without crossing the line between advice and guidance, we encourage firms to consider methods to reconnect customers with their data. This could be offering customers investment insights based on submitted data, such as excess money at the end of the month, which could be better utilised rather than kept in cash. If firms can help their customers easily use and understand their data and do so transparently, they will be more likely to gain their trust. This could lead to increased data sharing and enable the delivery of more personalised services that provide better customer experiences. This approach could also offer greater support to vulnerable customers.

In short, wealth firms should assess their approach to helping their customers share data. Firms need to consider whether they are doing enough to educate their customers on the significance and advantages of data sharing. Finally, to boost data sharing, the process must be transparent and engaging, helping customers feel secure and comfortable sharing more data.

Antonietta Price is a consultant at Simplify Consulting