Despite being small compared to some markets, the catastrophe bond market continues to grow, enhancing market depth and liquidity – that’s according to recent research from Morningstar released today.

In real terms, the catastrophe bond market now exceeds $40 billion, which is about double that of a decade ago. This growth trend coincides with the greater frequency of natural disasters and emphasises the ongoing need for insurance for losses related to catastrophes.

The appeal of this market is its lower correlation to traditional bond and stock markets due to the unpredictable nature of weather-related disasters, and potential for higher returns. The concept is as such: if a disaster doesn’t occur, the investor will receive their money back plus interest. If a disaster does occur, the investor can lose some or all of their money depending on the cost to the reinsurer. Morningstar’s latest report looks at how the market for catastrophe bonds has evolved over its roughly 25-year history.

“This higher risk and potential for individual bonds to experience significant losses means diversification is key when investing in a catastrophe bond strategy. The challenge for this asset class is that despite the years of data on such naturally occurring events, reinsurance companies try to assign reasonable probabilities to the occurrence of a specific event, but they lack any consistent predictability, particularly as climate change introduces additional uncertainties.” said Mara Dobrescu, Director of Fixed-Income Research, Morningstar

Key takeaways include:

- Some traditional bond and multi-asset funds use catastrophe bonds as diversifiers, in small sleeves, but this is far from widespread.

- Due to the complexity and uncertainty of this market, catastrophe bond strategies are typically more suitable for sophisticated investors with long investment horizons and no immediate liquidity needs.

- As of June 2023, Morningstar’s global database included 46 funds focused on catastrophe bonds and/or private insurance-linked securities, for a total of $ 16.5 billion. All funds labeled themselves as actively-managed, but their degree of differentiation versus the broader market is difficult to ascertain.

- The fund universe is lumpy: funds managed by GAM, Schroders and Twelve Capital take up the lion’s share of assets, which could raise potential capacity concerns.

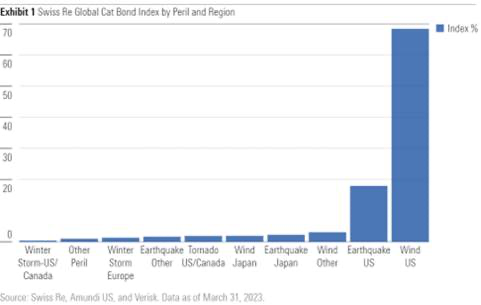

- On average, funds in the catastrophe bond cohort delivered on their promise of outperforming the broader global bond market and delivering low correlation to most traditional asset classes. However, a majority underperformed the most representative performance yardstick (the Swiss Re Cat Bond index).

- Fund managers charge high fees to investors on most share classes, while there are no passive options currently in the catastrophe bond space.

- Despite being small compared to other markets, the catastrophe bond market continues to grow, enhancing market depth and liquidity. According to Artemis, the catastrophe bond market exceeds $ 40 billion, about double that of a decade ago. This growth trend coincides with the greater frequency of natural disasters and emphasises the ongoing need for insurance for losses related to catastrophes.