Written by Abhinav Mehra, Co manager of the Chikara Indian Subcontinent Fund

India’s stock market is among the strongest performing globally. The ‘Nifty 50’s’ 125% return over the last five years beats even the 93% growth enjoyed by the S&P 500 during the period.

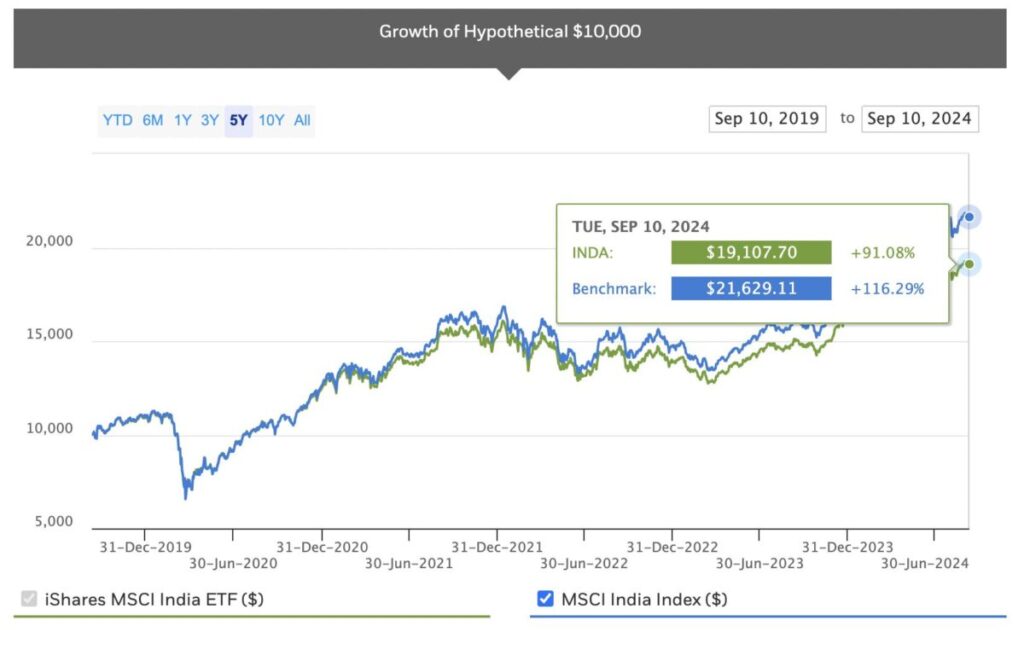

The chart below compares India’s large and mid-cap benchmark, the MSCI India Index, with the iShares MSCI India ETF over five years. But you might notice a unique quirk.

You’d expect the pair to have performed very similarly given the ETF mirrors the benchmark. Yet while the returns generated by both are no doubt impressive, they differ by some 25% in the benchmark’s favour. But why?

The little-known reason for the considerable difference is actually quite simple. It comes down to capital gains tax (“CGT”).

Funds investing in Indian listed securities pay local CGT regardless of their location.

India is one of the few countries which does so for foreign investors with a 20% rate charged for short-term gains and 12.5% for long-term gains, following recent Budget increases.

Most funds investing in India – whether passively managed like the iShares ETF or actively managed like our own – accrue CGT on unrealised gains on an ongoing basis to account for this obligation. This accrual, naturally, can therefore reduce net returns on a performance chart in periods of positive performance. Conversely, the opposite can be true in periods of negative performance.

However, the benchmark does not factor in the accrual of CGT on unrealised gains into its performance. And because the benchmark doesn’t show CGT drag, it has an

immediate advantage when it comes to comparisons with any fund benchmarked against it in rising markets.

Be careful around comparisons

This might sound like a technical point. But it’s very important.

We see two important takeaways from India’s unusual CGT obligation.

The first is the need for investors to approach benchmark comparisons with extra consideration in India.

The performance of the Indian index does not show the returns an investor would generate by investing in the same group of stocks. Their CGT obligation makes sure of that.

Even when a fund has generated gross returns in excess of the benchmark, the CGT drag is such that net returns may show underperformance in comparison.

The second takeaway is that, even with the drag of CGT, Indian funds have far outperformed most markets globally.

Indeed, MSCI India has seen annualised returns of 17% for the last 5 years, outperforming those generated by developed market indices like the FTSE 100 (8%), the MSCI Europe Index (10%) and even the S&P 500 (16%) over the same period.

The point is the ground remains fertile for continued outperformance in spite of CGT. Post-election, India is growing exponentially thanks to political stability, strong domestic consumption, a young workforce, and an increasingly wealthy middle class.

The nation’s GDP is expected to more than double to some US$7.5 trillion by 2031, making it the world’s third largest economy. The combined market cap of Indian companies is expected to soar too, growing at a CAGR of more than 11% to reach US$10 trillion in the coming decade.

This is clearly an excellent backdrop for investment returns. And the opportunity is further buttressed by the presence of pockets of value across the Indian economy.

For example, we see clear opportunities in areas such as private banks (which remain relatively undervalued despite increasing penetration) and property (where stocks are primed for a re-rating in the face of a new and very significant property cycle).

Minimising CGT, maximising opportunity

Whatever way you look at it, India is an investment powerhouse. The growth presented by the nation is so significant that even the drag of its onerous tax policy cannot prevent its significant outperformance on the global investment stage.

Still, investors wanting to get exposure to India must be mindful of the CGT factor.

As well as factoring it into any benchmark comparison they use, they should look for strategies that use a long-term approach to mitigate their tax burden as much as possible. After all, buying and holding stocks, rather than trading in and out regularly, can reduce CGT liabilities significantly thanks to the lower long-term tax rate.