Fidelity International (Fidelity) today reveals key findings from its Professional Investor DNA Survey, partnering with Crisil Coalition Greenwich in seeking the opinions of over 120 institutional investors and intermediary distributors across Europe and Asia, on investor appetite for incorporating ESG (environmental, social & governance) considerations into portfolio allocations.

According to the study, over half of investors still consider “E”, “S” and “G” factors as important when it comes to portfolio asset allocation over the next 18 months.

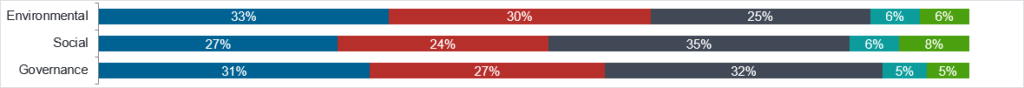

Chart 1: Importance of ESG criteria in portfolio allocation in the next 18 months

Q: Sustainable investing has evolved significantly in recent years. On a scale of 1 to 5, with 1 being ‘low importance’ and 5 being ‘high importance’, In next 18 months, how important will ESG criteria be in your portfolio asset allocation?

Environment is the top consideration, with two thirds (63%) of investors considering it as an important factor, with governance (58%) and social (51%) following suit. Leading the pack are European and institutional investors putting more emphasis on ESG criteria in portfolio asset allocation.

Looking into sustainability themes, the study reveals further investor focus on environmental considerations, with decarbonisation and the energy transition alongside the preservation of natural capital ranked in the top three themes in focus, likely driven by ongoing investor and policy maker commitments to reach net zero carbon emission goals.

Corporate transparency is ranked in second place overall, underpinning investors desire for strong corporate governance.

Chart 2: Most in-demand sustainable themes

Q: Which sustainability themes are you most focused on right now?

Difficulty measuring impact biggest barrier to investing sustainably.

While ESG is seen as important in asset allocation, barriers still remain. Difficulty measuring impact is seen as the biggest barrier to further adoption of sustainable investing (68% in total). Meanwhile, 52% of investors mentioned changes to or inconsistent regulations as a key barrier. In Asia, 66% of investors felt the lack of supply of quality strategies/products was a barrier – compared to only 31% in Europe.

Chart 3: Challenges and barriers to sustainable investing

Q: Looking ahead in the next 18 months, what do you perceive to be the main barriers when it comes to investing sustainably to a greater degree?

Jenn-Hui Tan, Chief Sustainability Officer, Fidelity International comments: “Our study shows ESG remains firmly on investors’ minds. While ESG investing may now be viewed as a mainstream consideration in asset allocation, further progress is needed to break down implementation barriers. This includes difficultly measuring impact, with observations pointing to difficulties sourcing and analysing good quality company data, and navigating regulation, where discrepancies remain across national, European and global regulatory frameworks.

“We continue to support increased data transparency and standardisation, and the harmonisation of global regulatory regimes that enable decision-useful disclosure. We also champion for greater focus on policies driving real world outcomes, complementing the role of enhanced disclosures in guiding investor choices.”

“In Asia, our study finds that product availability continues to lag Europe. A key area of focus in Asia is transition finance, which is being supported by national level transition plans, as well as innovative frameworks and product structures. We expect this will trigger greater product innovation, which responds to growing client demand.”

How to create positive impact

When asked about the most efficient way to create positive impact, the jury was out with investors citing a number of ways from impact investing (59%), exclusionary screening (52%), individual company engagement (44%) and government policy & regulation (44%), highlighting the multifactor approach needed when it comes to driving change.

Chart 4: Most efficient ways to create positive impact

Q: Rank which of the following you believe is the most efficient way to create positive impact?

Jenn-Hui Tan, adds: “We believe the integration of sustainability into investment research and portfolio construction is important as it can impact long-term value creation and drive better client outcomes. As an active manager and steward of client capital we have a part to play in moving towards a more sustainable economy which better takes into account system-level risk but as the study highlights, there is no one way to achieve this. This is why we believe effective stewardship combines bottom-up, thematic, and system-wide approaches.

“Measuring and attributing impact continues to be an industry challenge but as part of our commitment to driving meaningful and measurable change, we are in the process of developing an enhanced engagement framework to better measure the depth and quality of our engagements against specific objectives over time, allowing us to move towards a more outcomes-based engagement approach.”

Fidelity continues to incorporate ESG across its investment portfolio, developing a robust sustainable investing framework and actively contributing to key regulatory frameworks both at a global and local level. Fidelity focuses on four systemic themes: nature loss, climate change, strong and effective governance, and social disparities, to guide its active engagement approach.