The pace of net inflows into EMEA ETFs jumped to $14bn in March, bringing total net inflows for Q1 to a robust $42.6bn, according to Invesco’s European Demand Monitor. The Q1 2023 net inflows not only marked an acceleration versus Q4 2022, when ETFs attracted $27.2bn in NNA, but were almost half of the $87bn NNA total raised in all last year.

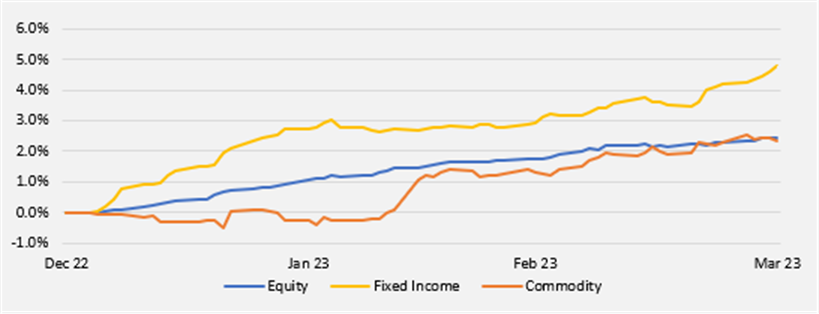

Equities led net inflows for the quarter with $23.3bn accounting for 55% of net new assets (NNA). However, this is lower than their current market share of 68%, possibly due to a combination of market strength, increasing concerns about the potential for a recession, and the problems in the banking sector that were seen in March.Fixed income attracted $16.2bn NNA, representing 38% of net inflows and punching above its market share of 24%. Meanwhile, commodities saw NNA of $2.7bn over the quarter accounting for 6% of net inflows, slightly below their market share of 8%.

Net new assets as a percentage of 2023 starting AUM

A prosperous Q1 for equitiesHaving experienced particularly strong demand in January, followed by healthy inflows in February and March, equity ETFs have had a prosperous first quarter with net inflows of $23.3bn. Broad emerging market equities have seen the strongest demand over the quarter with $8.6bn NNA accounting for 38% of total net equity inflows. With $8.1bn NNA, which represents 31% market share, global equities were the next strongest category in Q1, followed by broad Europe equities, which took in $4.3bn (19%).Fantastic fixed incomeInvestment grade credit was the strongest fixed income category for the quarter with $7.7bn accounting for 49% of fixed income NNA. With $5.8bn NNA and representing 37% of net fixed income inflows in Q1, government bond ETFs came in second position while aggregate bond ETFs saw steady demand over the quarter, taking in $1.8bn (12%).

ESG coolsIn Q1 2023 the $11.2bn of net inflows into ESG products, accounting for 26% of NNA, is a much slower pace than seen in 2022, when ESG accounted for 61% of NNA. However, it still punched above its market weight of 19%.Outlook for Q2 2023“March saw a change of tone in financial markets as the focus switched from monetary policy and the impact of inflation to more systemic concerns about the potential for a banking crisis,” said Matthew Tagliani, Head of ETF Product and Sales Strategy at Invesco. “While authorities’ rapid response seems to have prevented contagion, it has driven a change in sentiment towards risk assets and the outlook for interest rates, a shift which may have important implications for asset allocation in coming months.

“In equities, the unsteady economic outlook is likely to maintain investor focus on large, liquid core exposures,” continued Tagliani. “However, the end of the zero-COVID policy has rekindled interest in Chinese equities, which saw strong inflows last year and early in Q1, as well as emerging market exposures more generally.

“In fixed income, the risk-off sentiment created by recent events in the banking sector has driven a rotation towards government debt which, in addition to its perceived safe-haven nature, could also benefit from less hawkish central banks. We see a similar dynamic in gold, which is not only seen as a risk-off asset, but also as potential to hedge against inflation and a weaker US Dollar, and think this may drive further gold inflows in coming months.”

1 All data sourced from Invesco, Bloomberg, as at 31 March 2023. All figures in USD.