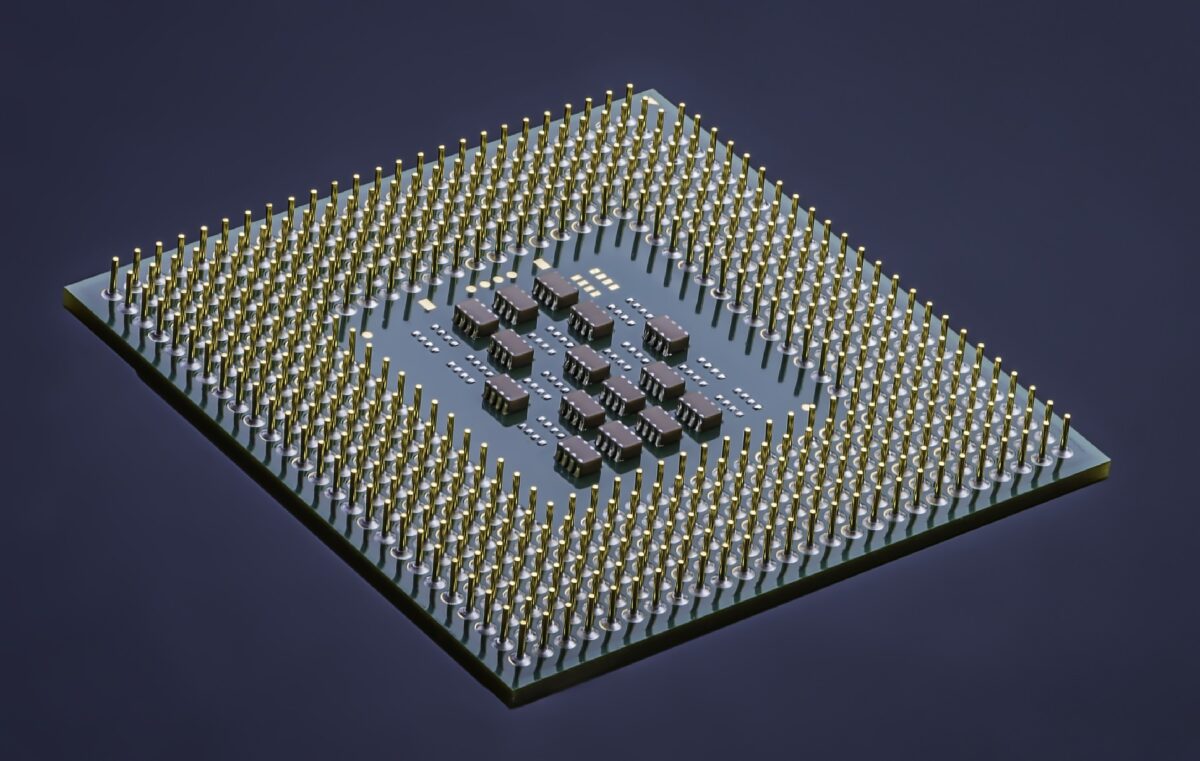

Going forward, the majority of data will likely be created by machines that require massive amounts of processing power. The challenge will be in increasing processing power and lowering power consumption.

Enormous amounts of data won’t reside in our phones, but in data centres. Today, data centres account for roughly 3% of global electricity consumption. If we do nothing to make them more efficient, they might account for 25% of electricity consumption in 10 years. Given this dilemma, the rule of thumb in semiconductor design is to try to reduce power consumption in these components by 30% every two years.

In our view, this is likely to drive growth for more advanced and complex chips used in high-end smartphones and data centres, which will drive up their semiconductor dollar content over the next five years.

A massive semiconductor spending cycle is coming

The world’s largest semiconductor companies are planning to spend billions of dollars on new manufacturing facilities to meet new demand, as well as to navigate geopolitical tensions with semiconductors being seen as a national security priority. The US and Europe both seek to bring critical supply chains closer to home, given that Taiwan controls a majority of the high-end manufacturing production for semiconductors.

Industry bellwether Taiwan Semiconductor Manufacturing (TSMC) plans to spend $100 billion through 2023 for new chip fabrication facilities, including a large site planned for Arizona. TSMC holds close to 80% market share for leading-edge chip production, and its clients include Apple, Qualcomm and Broadcom.

Meanwhile, Intel plans to spend $20 billion on two new plants in Arizona, and Samsung Electronics is eyeing construction of a new manufacturing facility in Texas worth $17 billion. Spending comes after a long period of capital discipline and industry consolidation, which has left the business with two dominant players: TSMC and Samsung, with Intel a distant third.

However, it’s unclear how these new foundries might benefit the industry longer term, and this is something we’ll be watching closely. Manufacturing processors in the US will likely cost more than in Taiwan or Korea, where most of the current capacity lies. This could create market inefficiencies. It’s also unclear if US semiconductor and technology companies, almost all of whom outsource the manufacturing of their chips to Asia, will want to bring it onshore.

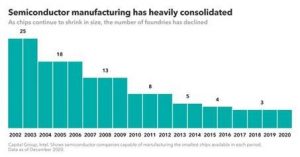

Industry has consolidated across segments

Following several rounds of consolidation, each segment along the supply chain — the chip designers, chip equipment manufacturers, the foundries that make the chips and the companies that test the chips — is dominated by a few companies.

With highly specialised expertise in each of these areas, competitive moats have expanded. Many of these companies are well-managed, with a stronger grasp of customer demand patterns. Pricing power remains high and margins are attractive.