Semiconductor equipment makers: This market has heavily consolidated, with the top five companies controlling close to 75% market share, up from roughly 40% 15 years ago. These companies, including ASML in the Netherlands and Applied Materials and Lam Research in the US, have developed wide competitive moats, with each company developing its own specific niche within the semiconductor manufacturing and testing process.

As a result, they’ve become difficult to supplant given the complexities of their machines. For example, an extreme ultraviolet lithography (EUV) machine, used to make advanced chips, is made of more than 100,000 parts, costs approximately $120 million and is shipped in 40 freight containers. ASML is essentially the only manufacturer of this equipment.

The equipment makers have further developed a servicing model with recurring revenue from machine maintenance. Operating margins have averaged 25% over the past five years and are on track to expand beyond 30% based on our estimates. In years past, they would dip into the single digits.

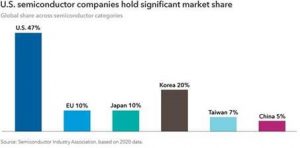

Memory chips: The industry structure has evolved, and it’s become more attractive. Memory used to be a cyclical, commodity-like business. It’s shrunk from around 15 companies globally to three, the biggest being Korea’s Samsung Electronics. In turn, the industry has become more disciplined and rational. And memory chips remain a critical component for computing processors used in a wide range of devices. Although Korea accounts for almost three-fourths of global memory chips manufacturing, the US still dominates the global semiconductor market with about 47% share due to its dominance in fabless, equipment and intellectual design segments.

Strategic importance stirs geopolitical frictions

As semiconductors have become strategically imperative, it has raised concerns among government officials in the US, China and Europe, who are all driven by their own motives.

The US worries that while its companies are global leaders in chip design, the country ceded leadership in manufacturing years ago to Taiwan, namely TSMC. Currently, US market share for chip manufacturing is 12%, down from 37% in 1990.

Meanwhile, Europe is concerned that it lacks any manufacturing capabilities for cutting-edge semiconductors. This became amplified during the recent chip shortage that hurt big German automakers.

For China, its leaders want to reduce the country’s dependence on US semiconductors. Given current US trade sanctions, China has defined semiconductors as a strategic imperative in its most recent five-year plan. It will take time, but with the money and resources that China is devoting to the effort, it will develop some capabilities, just as it has in other industries.

As semiconductor chips become integral to virtually every industry and are essentially the “brains” for most things we use, their importance will only grow. Whether the strategic imperatives that drive public policy chip away at some of the industry’s efficiency and execution prowess is a trend we will be closely watching.