The average AIM IPO almost doubles over 5 years

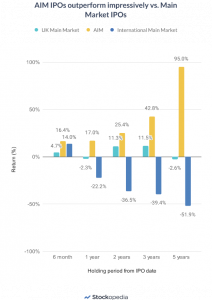

Providing further support to the idea that small and micro-cap IPOs outperform mid and large caps is the fact that the average IPO performance on the Alternative Investment Market (AIM) beats that of the UK Main Market by a considerable margin across almost all timeframes.

The average AIM IPO almost doubled over a 5-year period, whereas the UK Main Market return was negative. This striking outperformance is evident from the 6-month mark onwards, with AIM beating the main indices over every time period thereafter.

Healthcare and tech IPOs are best for all-time returns

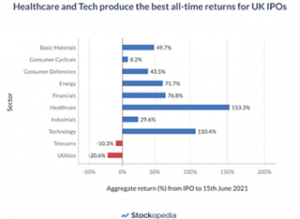

Although the odds of picking big IPO winners are low for private investors, Healthcare (+153%) and Technology (+110%) IPOs have offered the most promising returns over the past five years, accelerated by demand during the COVID-19 pandemic.

Financials (+77%) and Energy (+72%) are also both strong performers, whilst Consumer Cyclicals (+8%), Telecoms (-10%) and Utilities (-21%) have provided sub-par returns.

The UK Chancellor of the Exchequer recently announced a proposed shake-up of listing rules so that “the most successful and innovative companies” list on the UK market –which could be good news for tech IPOs.

However, more needs to be done to level the playing field between the city and individual investors. The full report can be explored here.

Ed Croft, CEO of Stockopedia commented on the findings:

“We hope that our analysis of 258 UK IPOs has helped to shed some light on the truths surrounding IPOs and provides a reference point for further research.

When participating in IPOs, investors really need to keep their eyes open and understand what they are being sold. Our research shows IPOs are often structured in a way that benefits existing and institutional shareholders – with evidence of large-cap over-pricing and first-day price pops for deal insiders.

“Post IPO excitement can push prices higher in the short term, but the odds of longer-term outperformance are surprisingly low. Our research shows that by focusing on better quality, reasonably valued IPOs may have a significant bearing on performance.”