Michael Browne, Chief Investment Officer, Martin Currie

The UK’s economic backdrop is suggesting this could be 1997 again

- Real wage growth and full employment has overturned a negative outlook and seen the UK economy grow – but the Purchasing Manager Index growth (PMI) actually suggests broader-based growth

- Post election, any incoming government will be fiscally neutral, reassuring bond markets. Certainty for corporate and consumers backed by interest rate cuts should support solid economic growth over next 12 months

- Sterling’s increasing strength is potentially a once-in-a-generation event. We’ve been here before in 1997 when currency strength and falling gilt yield supported a positive outlook for UK equities

The UK economy progressed as we expected in the first half of 2024. The perennial negative outlook was met by a series of better-than-expected data points that has seen the economy gently grow, and the negative second half of 2023 has been overturned.

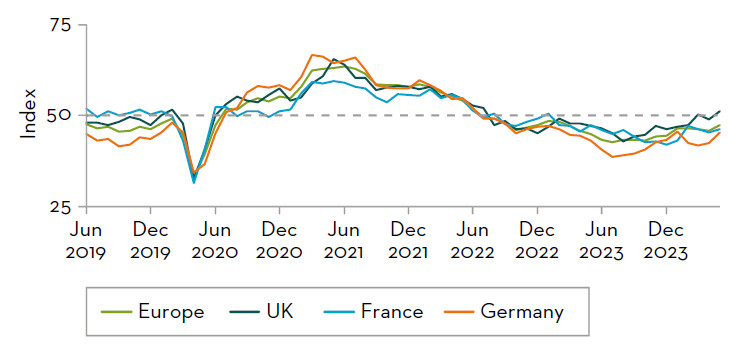

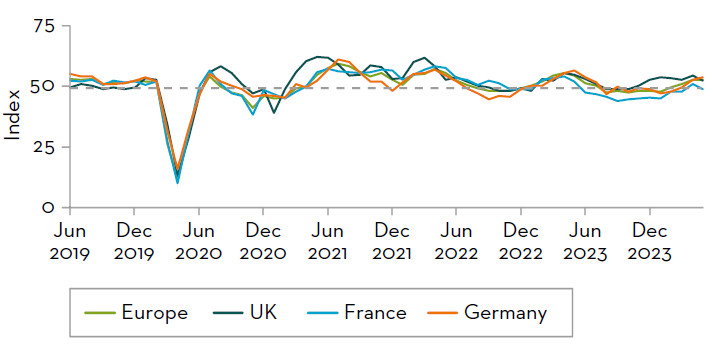

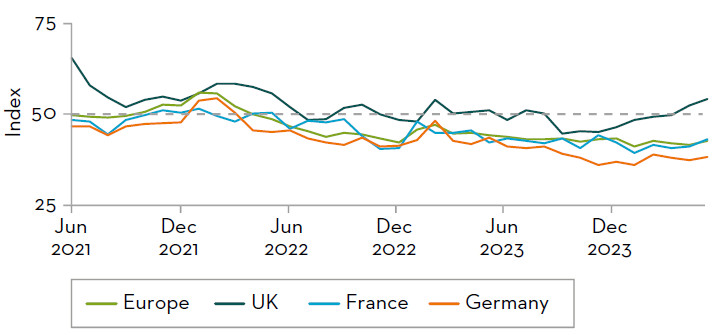

Key in the short term have been real wage growth and continuing full employment. But the reality is that the recovery has been broader than that: as the PMI data shows, the UK is the only country in Europe which has a positive outlook in services, manufacturing and construction and it is striking.

Manufacturing PMI – five years

Services PMI – five years

Construction PMI – three years*

Source: Martin Currie, FactSet and OECD, as at 31 May 2024. *Construction data only available since 2021.

Recovering confidence

The question is, what will happen in the second half of the year after the election, assuming the UK enters a period of stability? Whilst any incoming government will alter the balance of taxes, with windfall taxes on energy and utility companies, the overall position is likely to be fiscally neutral which will reassure the bond markets. The certainty given to both corporates and consumers will add confidence to the recovery and, backed by interest rate cuts, the next twelve months should show solid growth. Although not even the most ardent optimist would be predicting growth faster than 2%, that was the average growth rate from 2010-20191.

The key will be inflation. The accelerant of inflation is energy and the transmission mechanism to the consumer is food and fuel. Unless there is a major new conflict, energy prices ought to continue to stabilise and thus the secondary effects should as well. This will lead to a more benign inflation picture in 2025 and pave the way for further rate cuts.

Sterling’s strength could be a once in a generation event

It is worth recognising that the international perception of the UK is changing. A change of government, to one more moderate and international in tone, coupled with a deterioration of the European political stability, notably in France, indicates that there remains room for sterling to appreciate. This would be beneficial for lowering inflation rates even further.

Should the Bank of England’s Monetary Policy Committee (MPC) be slow to cut rates in the second half of 2024, while the European Central Bank is doing the opposite, then the chance rises for sterling to further appreciate. At the same time, a reduction in the risk premium for UK assets could accelerate sterling’s move and positively surprise the equity market.

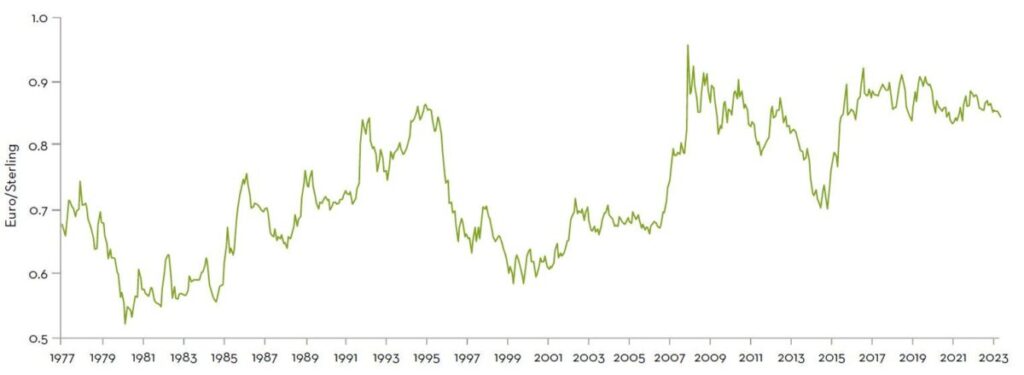

We’ve seen this before, with three reversals of the euro against sterling (prior to 1999 the European Currency Unit is used). In each period, we’ve seen a fiscally prudent UK versus a weak and uncertain Europe.

Sterling versus the euro – 30 years

Source: Bloomberg as 25 June 2024. *Prior to 1 January 1999, the European Currency Unit is used, a basket of European Economic Community currencies.

In late 1970s and early 1980s, Margaret Thatcher had taken over and was squeezing inflation through high interest rates in the UK, this was as France’s Francios Mitterrand was pursuing an agenda of nationalisation. Then from 1996-99 as the euro was being introduced there was real economic uncertainty, especially in Germany. In contrast the UK economy was strengthening, then Tony Blair was elected in May 1997. Finally, between 2010 and 2015 with UK Conservative/Liberal Democratic coalition, there was a period of sound money management and low growth. Europe was recovering from the sovereign debt crisis.

Let’s make one more comparison, again with 1997 and an incoming Labour government. UK gilts and sterling were rallying and continued to do so once Blair was elected.

Sterling versus the euro – 30 years

Source: Bloomberg as 25 June 2024.

We are seeing the same conditions now, could this be a repeat of 1997? Sterling is getting stronger, and we are more than likely to have an incoming Labour government. To quote a well-known campaign slogan from 1997 “things can only get better?” With the current backdrop we would like to think so for the UK’s equity assets.