By Libby Cantrill, PIMCO head of U.S. public policy

What looks to be one of the closest presidential races in modern history is (at long-last) coming to an end. As of Monday morning, nearly half (48%) of the 2020 electorate (~155 million) has already voted early (either in-person or by mail), which means that depending on election day turnout, 2024 could be one of the highest voter turnout elections ever.

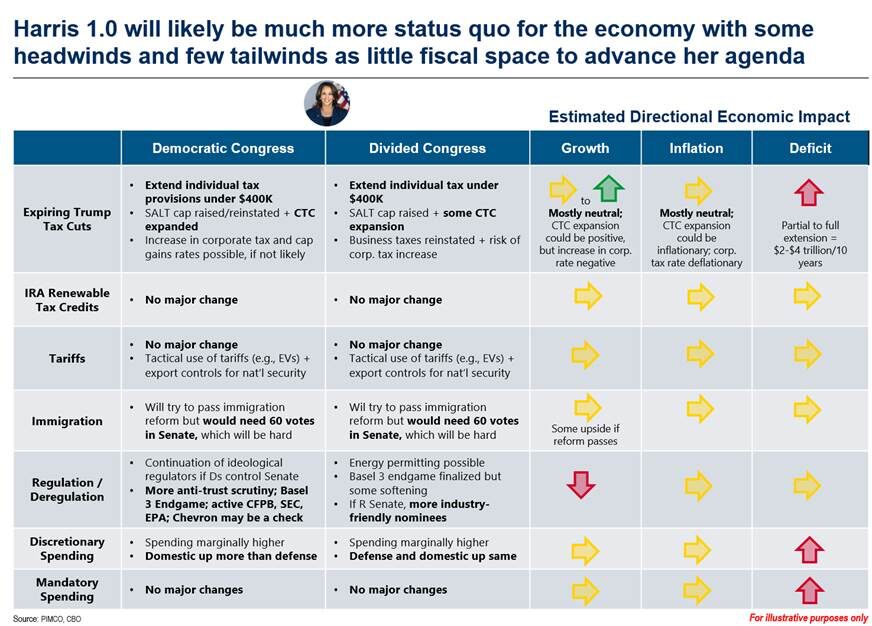

- Potential economic impact of the candidates’ policies: We continue to think that in many ways, there are fewer differences between the candidates than what the market assumes. Specifically, 1) deficits will be higher under either Kamala Harris or Donald Trump – and the differences between the two are not likely to be that much different due to the narrow Congressional majorities that either will likely have to contend with); 2) both candidates will have to deal with taxes in 2025 due to the expiring tax cuts under the Trump Tax Cuts and Jobs Act, and in either case, we are likely to see most, if not all of the tax cuts be extended; 3) both candidates will continue to be hawkish on China; and 4) the Fed will remain independent due to institutional guardrails and no current vacancies (and despite some jawboning that we can expect if Trump wins in particular).

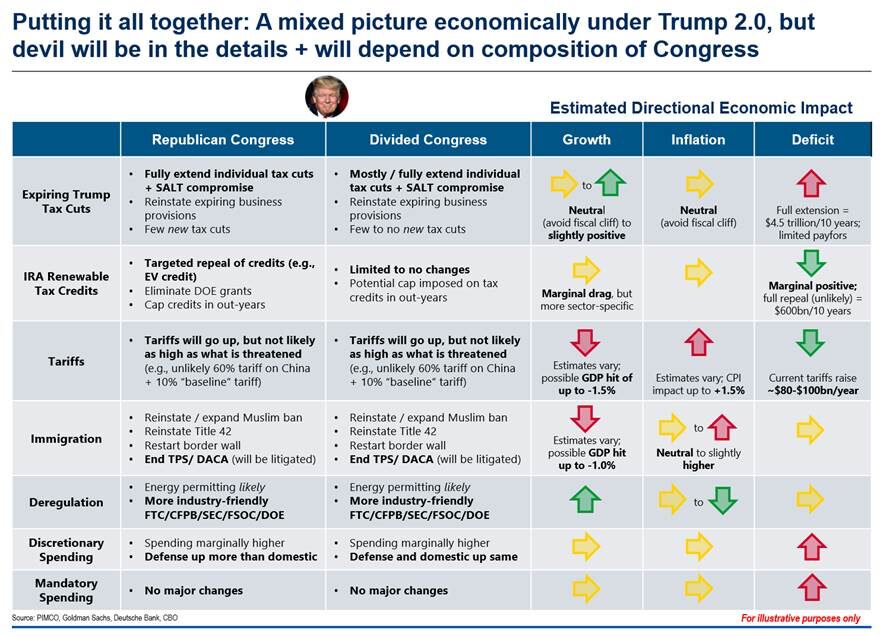

- The big differences will be on 1) tariffs, which are likely to stay high under Harris on China but will likely go higher under Trump and other countries are likely to be subject to increased tariff pressure as well 2)immigration, although we would note that for Trump to do some of what he is said he will do would largely require Congress, and 3) regulation, where we would expect Trump to have a lighter touch (we would note that reversing regulation is hard, although there would undoubtedly be more regulatory certainty under Trump from the absence of new regulation as well as rolling back Biden executive orders).

- In terms of the collective economic impact of each candidate’s policies, there are some tailwinds and headwinds under both, although for Trump given a president’s unilateral authorities over tariffs, there are more risks from both an inflation and growth perspective as it relates to tariffs. Below are our best-guesses, although we put this together with a lot humility given much of it will depend on Congress as well as which personnel are in place (keep in mind, in many cases, personnel truly is policy).