- How global equity sectors are performing

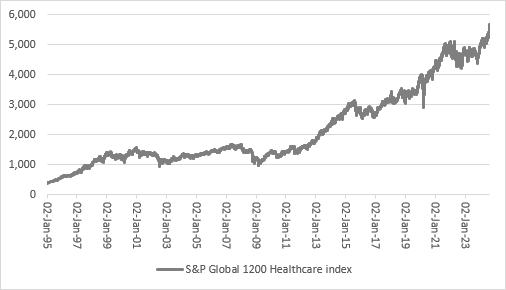

- Financials and Healthcare sectors trade at all-time highs

- Industrials, Consumer Staples and technology not far away

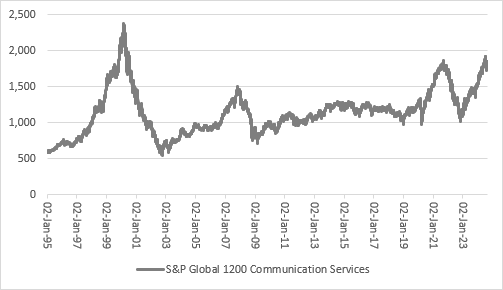

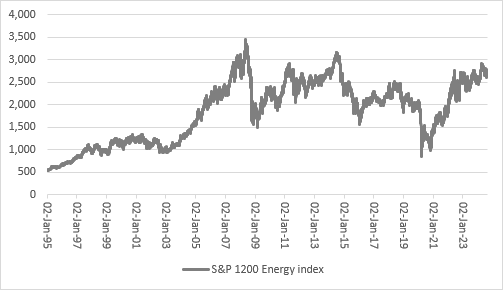

- Energy and Telecoms are the laggards

- Telecoms has yet to regain the peak reached during the 2000 bubble

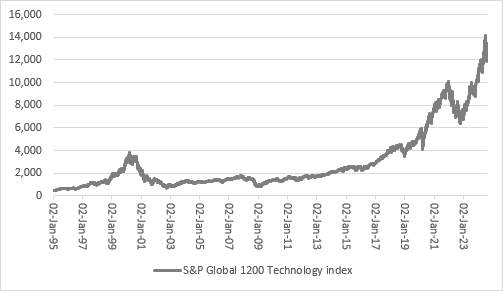

“Investors continue to grapple with whether technology stocks are in a bubble or not, and how their future performance – up or down – could influence global stock markets more widely, but tech is not the only sector trading at or near all-time highs,” says AJ Bell investment director Russ Mould. “Many investors take the view that a ‘bad’ stock in a ‘good’ (or fashionable) sector will outperform a ‘good’ stock in a ‘bad’ sector, at least in the near term, and so it may be worth assessing which industries are seen to be thriving and which are having to do their best merely to keep on surviving.

| Peak | Days since all-time high | Index distance from all-time high | |

| Financials | 30-Aug-24 | 4 | 0.0% |

| Healthcare | 30-Aug-24 | 4 | 0.0% |

| Industrials | 30-Aug-24 | 4 | (0.7%) |

| Consumer Staples | 27-Aug-24 | 7 | (0.2%) |

| Technology | 10-Jul-24 | 55 | (6.9%) |

| Real Estate | 31-Dec-21 | 977 | (14.7%) |

| Consumer Discretionary | 18-Nov-21 | 1,020 | (13.1%) |

| Materials | 10-May-21 | 1,212 | (6.6%) |

| Energy | 21-May-08 | 5,949 | (20.1%) |

| Utilities | 07-Dec-07 | 6,115 | (2.9%) |

| Telecoms | 06-Mar-00 | 8,947 | (22.8%) |

Source: LSEG Refinitiv data. Prices as of 30 August 2024

“That said, you can see why some investors are nervous about the risk of a bubble in technology, given the sector’s vertiginous rise of the past couple of years and the damage wrought by the last speculative episode. That ended with a bang, not a whimper, as J.K. Galbraith once put it, and it took the S&P Global 1200 Technology index more than seventeen years to regain the ground it lost during the carnage of 2000 to 2003, when the bubble burst and valuations (and confidence in the sector) collapsed.

Source: LSEG Refinitiv data

“Bulls of tech stocks will be wanting to see the global index recapture its all-time high, and push on to new peaks, quickly, to reassure them that the rally that has followed August’s wobble is not a bear trap – just as so many false rallies lured bulls into deeper and deeper trouble in 2000 to 2003.

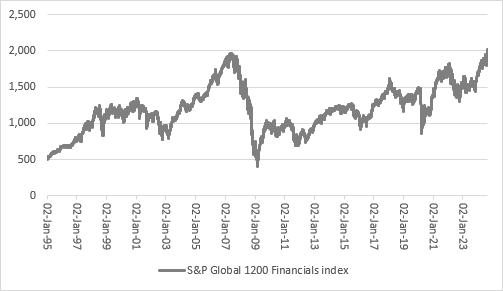

“Investors in Financials will also be only too well aware of how long it can take for the good times to roll again, once a sector falls out of favour. Financial engineering, risk-taking and high leverage were all the rage as the US Federal Reserve (among others) ultimately left interest rates too low for too long in the wake of the bursting of the technology, media and telecoms bubble. Bank stocks in particular soared during 2003 to 2007, only to crash as the Great Financial Crisis stripped bare the benefits of an alphabet soup of housing- and debt-related derivative products and showed the enormous damage done by the downside of the risks taken. Only now, seventeen years after its peak, is the S&P 1200 Global Financials index returning to the pre-Crisis peak.

Source: LSEG Refinitiv data

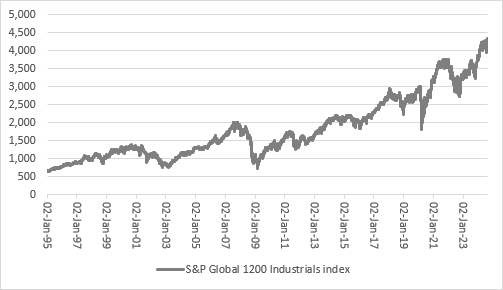

“Renewed faith in Financials could reflect investors’ confidence in the global economic cycle and central banks’ ability to support it with judicious interest rate cuts, and the strength in Industrials stocks plays to that narrative, too.

Source: LSEG Refinitiv data

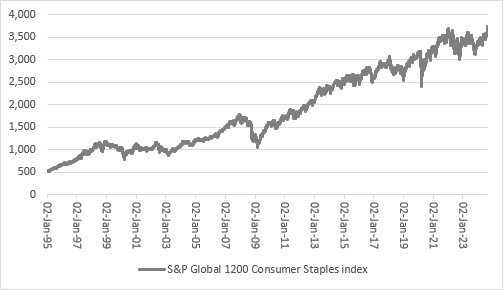

“However, the ongoing strength in doughtier, less economically sensitive sectors such as Consumer Staples and Health Care suggests that investors remain keen to diversify and avoid putting all of their faith in the narrative of cooler inflation, a soft economic landing and interest rate cuts. Both sectors have pricing power, to varying degrees, a useful facet for investors who fear inflation, stagflation or even a recession.

“New product developments, in areas such as weight loss, and stunning performance from stocks like Denmark’s Novo Nordisk, now the globe’s fifteenth-biggest company by stock market capitalisation, are also factors in Health Care’s favour, alongside well-understood trends such as global population growth and increased longevity.

Source: LSEG Refinitiv data

Source: LSEG Refinitiv data

“Contrarians and value-seekers could be forgiven for looking more closely at those sectors that have been out in the cold for a very long time.

“Unlike Technology, Telecoms have never got back to the turn-of-the-century highs, in a classic example of how competition, technological change, and regulation can hobble a company or an industry, especially if a large dollop of debt is thrown in on top.

“Retrenchment, asset sales and debt reduction are helping some stocks in the sector, which has also seen private equity tentatively sniff around its potentially reliable cash flows, but investors still seem relatively unconvinced.

Source: LSEG Refinitiv data

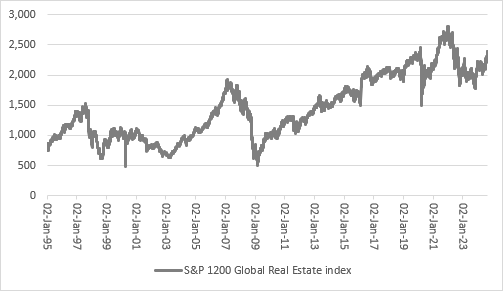

“Real Estate remains another thorny one, as investors ponder the impact of the ongoing rise of online shopping, relative to brick-and-mortar stores, and whether working from home and hybrid working will prove a fad or a long-term fixture (a recession and rising unemployment may have the ultimate say here, even as office workers slowly creep back to the desk, voluntarily or otherwise). The rise of new sub-sectors, such as logistics and warehousing, data servers and care homes, also mean the industry continues to offer different options, even as the more traditional areas of high street retail, sites for retail and leisure parks and office space fight to prove their worth to investors.

Source: LSEG Refinitiv data

“The other notable laggard is Energy. It has never recaptured the high reached in 2007, when oil briefly hit $147 a barrel, and investors continue to worry about how quickly the globe can transition away from its reliance on hydrocarbons and toward a net-zero world. For environmental campaigners, this cannot happen fast enough. For oil and gas executives, and their shareholders, it is a threat, although these firms still generate sufficiently copious cashflow that they could yet be part of the solution, as they have the deep pockets required to help the world re-tool and embrace renewable technologies.

Source: LSEG Refinitiv data

“For now, investors seem more concerned that oil and gas fields will become stranded assets, worth much less than current fossil fuel prices suggest, even allowing for how ongoing conflicts in Eastern Europe and the Middle East are reinforcing the importance of self-sufficiency in vital commodities for national security. The debate over how quickly the world can move toward renewables and net-zero, and how easily and painlessly that shift can be funded and managed, also refuses to go away, as do memories of the oil price shocks of the 1970s in the wake of a war on Israel’s borders and then the unseating of the Shah of Iran.”