7IM’s Pathbuilder fund range has surpassed £500 million in assets under management (AUM), more than doubling over the past 12 months. This milestone is particularly significant given that the range has yet to reach its five-year anniversary.

This increase in demand reflects a growing interest in the differentiated and diversified approach 7IM takes to long-term asset allocation. Advisers who are starting to worry about the dominance of US markets in pure market-cap weighted portfolios are looking for other approaches to blend with – and the performance of Pathbuilder is standing out.

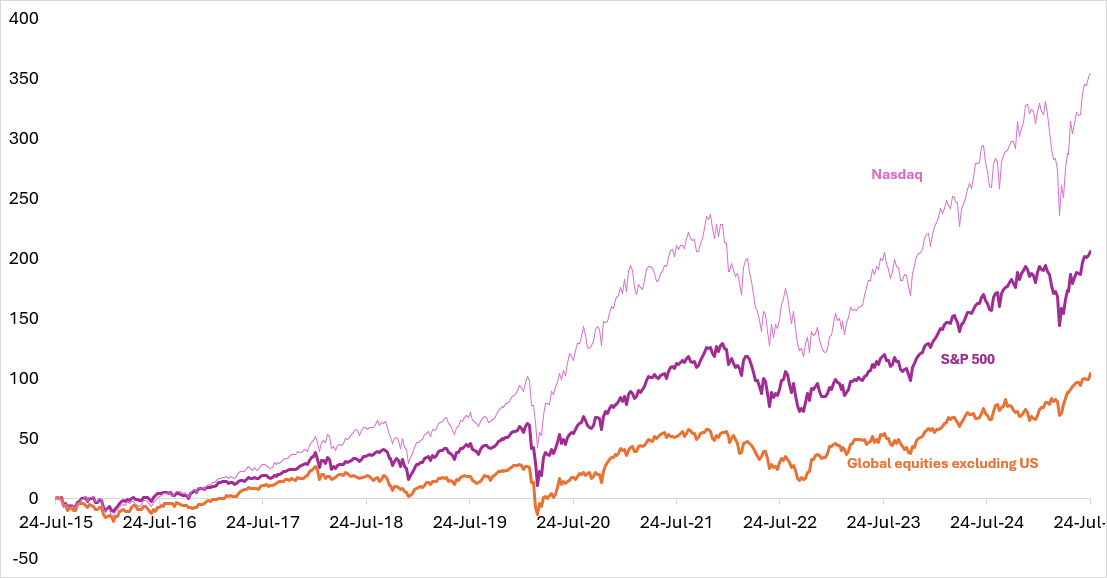

This concern is illustrated by the chart below, which compares the relative returns of the Nasdaq, S&P 500, and global equities excluding the US over the past decade. While US markets – particularly the so-called “Magnificent 7” tech stocks – have delivered exceptional returns, the gap has begun to narrow. The question many are now asking is: Are 10 years of exceptionalism coming to an end?

Source: FactSet/7IM. Past performance is not a guide to future returns.

The Pathbuilder portfolios are built using 7IM’s strategic asset allocation process which has been running since 2003. This approach prioritises diversification through analysis of statistical factors, rather than just return expectations (which vary a lot). For example, the UK equity market has completely different businesses and industries when compared to the US equity market; giving it more exposure to factors such as commodity prices and inflation shocks (no bad thing in the current world!). As a result, Pathbuilder portfolios look a little different to standard global approaches – a broader spread of sectors and regions, in both equities, bonds and currencies.

Pathbuilder portfolio allocations are reviewed annually, with 7IM always looking for areas to improve. Alternatives are a key specialism for 7IM, and where they can access them at a reasonable price, the team believe they’re worth investigating – last year, 7IM added trend-following as a diversifying alternative to the lower risk profiles.

It’s been a great few years for US equity – but as the world changes, it’s becoming clear advisers are looking for something a little different, with a solid process behind it. Matthew Yeates, co-Chief Investment Officer at 7IM, commented: “With the relatively mixed performance of large-cap US equities year-to-date, planners are increasingly telling us they’re looking for low-cost solutions to blend with more US-centric offerings. Assets in the Pathbuilder range have doubled over the past year, and we expect that momentum to continue.”