One of the world’s largest economies shows signs of momentum after an age of stagnation. For decades, Japan’s economy has essentially been stuck in place.

Japanese companies soared after recovering from World War II, but in the early 1990s, the nation entered an era of economic malaise. A major stock market bubble burst, and consumers and companies cut back sharply, stifling demand. Wages sputtered, and the nation’s aging population acted as another drag on the economy.

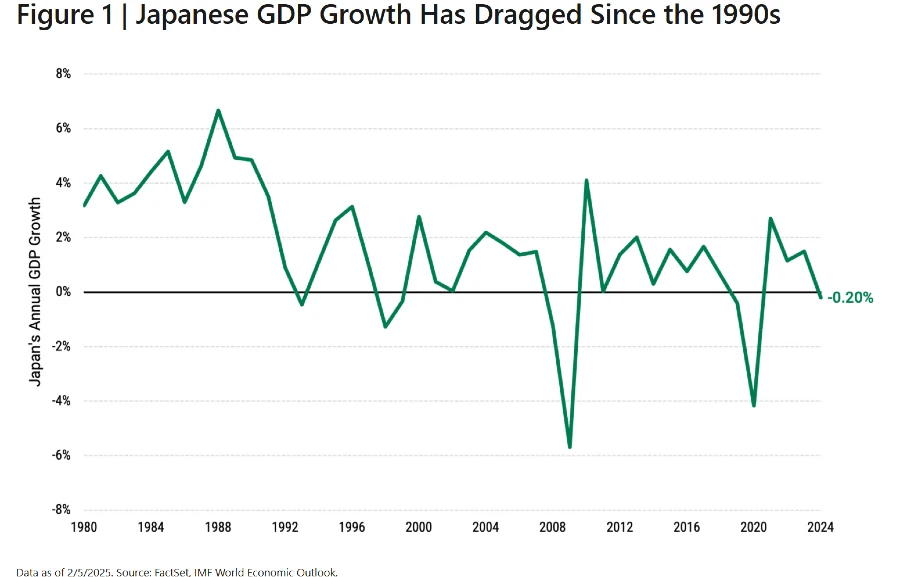

Since then, Japan’s economy has trudged forward but never recaptured its previous levels of gross domestic product (GDP) growth. See Figure 1.

Recently, however, multiple forces have combined to reignite its economy. Corporate governance reforms, increased information technology (IT) investment, and other movements might create momentum for Japan to break free.

We believe seven trends could help propel Japan’s economy and select businesses.

1. Reforms Force Companies to Evolve

In 2012, the government unveiled policies designed to stimulate economic growth. Dubbed Abenomics after then-Prime Minister Shinzo Abe, the initiative consisted of “three arrows,” a set of policies involving fiscal stimulus, monetary easing and structural reforms.

Corporate governance became a focus as Japan implemented policies to make companies more competitive. Overall, Japanese businesses have produced a lower return on equity than U.S. and European firms.

As part of the reforms, the Tokyo Stock Exchange (TSE) pushes companies to set and disclose profitability targets. The exchange also wants businesses to provide investors with more details on strategies, risks and other nonfinancial information.

The updated guidelines apply more scrutiny to publicly traded companies holding shares in each other, known as cross-shareholdings. The guidelines also encourage independent directors to serve on corporate boards.

Businesses have an incentive to meet these higher standards. The TSE regularly publishes lists of companies that have disclosed their efforts to comply with the new guidelines. Taken together, we expect these changes to improve performance and transparency at Japanese companies, making them potentially more attractive.

2. Inflation’s Return May Benefit Japan’s Economy

After decades of deflationary economics, Japan’s inflation rate has moved closer to the 2% annual target. The Bank of Japan expects it to remain in that range for the 2025 and 2026 fiscal years. While most of the world has moved aggressively to tamp down inflation since the pandemic, slightly higher inflation is arguably good for Japan. Companies have more power to raise prices, and the economy is growing.

Part of this change is due to demographics. The country’s population is one of the world’s oldest, with a median age behind Monaco and the French archipelago of Saint-Pierre and Miquelon off the east coast of Newfoundland. Japan is smaller, too. Population growth has been negative every year since 2011. According to one government forecast, if current trends continue over the next 50 years, Japan’s population could shrink to 70% of its current size.

An older, smaller population means fewer workers, driving up labour costs. In 2024, wages grew by more than 5% for the first time since 1991. Higher wages are expected to support improved consumer sentiment and spending, ultimately benefiting the economy.

Competing for workers might present another challenge for Japanese companies, but a more dynamic workforce could strengthen businesses. When employees move to new jobs, they often bring expertise gained from previous employers, which can encourage innovation.

3. Digitisation Efforts Boost Japan’s Competitiveness

In recent years, Japan has placed greater emphasis on IT as part of a digital transformation (DX) campaign. A major catalyst was a 2018 report warning that businesses that didn’t upgrade to newer systems could lose trillions of yen yearly.

It’s been a major change in a country where people mostly deal in cash. Many government agencies relied on compact discs, floppy disks and other older forms of data storage.

Demographics also help drive DX. As hiring becomes more competitive, corporations are trying to increase the productivity of their existing workforce by arming them with better technology and tools. IT consultants such as BayCurrent Consulting, Hitachi and NTT Data benefit from this trend.

Foreign IT companies have made inroads in Japan’s DX market but are often at a competitive disadvantage due to language and cultural hurdles. Even in cases where outside firms have made significant progress, they’re collaborating with local companies to install and service solutions for Japanese clients.

Meanwhile, the DX movement creates opportunities for other Japan-based companies. A good example is MonotaRO, which enables companies to purchase industrial equipment online. Buyers previously placed orders via fax machine.

4. Incentives Strengthen Japan’s Supply Chains

Since COVID-19, Japan has dedicated more resources to strengthening its domestic supply chains by creating programs to promote reshoring and nearshoring.

The goal is to ensure stable production of essential goods and products, such as semiconductors, auto parts and medical supplies. The government has supported these efforts with more than $2 billion in equipment and logistics facilities subsidies. This has helped create demand in industries that support these projects, such as construction, electrification, and machinery.

5. Rising M&A Activity Spurs Corporate Growth

The Japanese government updated its guidelines to promote mergers and acquisitions (M&A) because it sees these deals as a way to spark corporate growth. A more active M&A market is expected to foster improved capital efficiency and company management, benefiting the larger economy and society.

The government’s encouragement helped spur 2024 M&A activity to its highest level since 2007. Specifically, the number of M&A deals increased by 17.1% in 2024 on a year-over-year basis. Deals between Japanese buyers and sellers comprised the lion’s share of the activity, though the value of those transactions declined by 18.4% year over year.

6. Economic Impact of a Weaker Yen on Japan

The yen fell against the U.S. dollar in 2024, making goods manufactured in Japan more attractive to foreign buyers. Indeed, despite lower prices, the value of its exports increased by 6.26% last year, according to provisional numbers from the government. The total value set a new record, though Japan still has a trade deficit.

A weaker yen may also encourage more tourism. Last year, the number of international visits was up more than 47% over 2023, surpassing pre-pandemic levels. Increased tourism benefits department stores, fashion boutiques, and other retailers. This spending could help support consumer spending despite Japan’s shrinking population.

7. Japan’s New Regulations Boost Stock Ownership

Japan is trying to attract more retail investors to increase household wealth and make more capital available for corporate expansion. Japanese households have kept roughly half their financial assets in cash and deposits. In fiscal year 2023, only about 14.2% was held in equities.

To change this dynamic, Japan has revised the tax-advantaged Nippon Individual Savings Accounts (NISA) rules by raising contribution limits and making tax exemptions more generous.

Morningstar reported that investment has surged since the changes took effect in 2024. Last year, NISA investors represented about 30% of gross inflows to mutual funds, compared to closer to 10% in the three previous years.

Exploring the Potential for Japan’s Economic Growth

We believe Japan’s ongoing efforts to improve efficiency and boost earnings are starting to impact the nation’s stock market positively.

In many cases, trends such as improved corporate governance, the return of inflation and increased digitization reinforce one other. They can potentially support a significant change in the Japanese economy, lifting the nation out of its malaise.

Provided by Rajesh Gandhi, CFA, and Brent Puff are Senior Portfolio Managers at American Century Investments