Is it time to embrace an unconstrained approach in corporate bond investing? Analysis from Mark Munro, Investment Director, Aberdeen Standard Investments.

The most interesting question now for fixed income investors is can bonds provide similar returns over the next five years to those of the previous five years? Potentially the biggest obstacle to achieving that is higher inflation, something that has not been high on anyone’s agenda since the global financial crisis.

However, a strong economic rebound is now expected, helped by both supportive central bank stimulus and large fiscal spending at the same time. This is widely expected to put at least some upward pressure on prices, which has resulted in a sharp rise in core government bonds yields over recent months.

Structural drivers will dominate

In the case of both the 10 –year US treasuries and 10-year UK gilts, yields have jumped by more than 60 basis points compared to end 2020, to around 1.5% and 0.7% respectively. As bond prices move in the opposite direction, continued sustained yield rises would be problematic for both government and corporate bonds.

So the outlook for inflation is very important. Our view is that inflation will likely rise in the short term as the economic recovery proceeds. However, the magnitude of rises should be constrained by the scarring of the pandemic, potentially higher unemployment and associated spare economic capacity. Furthermore, after an initial spurt, over the longer-term we think it’s quite likely that the structural drivers of low inflation will once again dominate.

An unconstrained approach

Having said that, we would agree with the Bank of England governor’s recent assessment that inflation risks are now ‘increasingly two-sided’. In this context, the likelihood of the whole bond spectrum doing quite as well as in the past 5-10 years seems less likely.

With the debate around inflation risks increasing, volatility in both core yields and spreads is also likely to rise. We think this will call for a much more selective and flexible approach to bond investing. For corporate bond investors, an unconstrained approach to investing is more likely to successfully navigate challenges.

One example of unconstrained investing and highly relevant to inflation is duration, or interest rate sensitivity. Most credit indices have quite high duration, which is fine when inflation is low and yields falling. However, the flipside of this is greater vulnerability to higher inflation and rising yields.

Unconstrained approaches are typically more defensive in this respect as they tend to have lower duration. Furthermore they have much greater flexibility to dial down duration if needed.

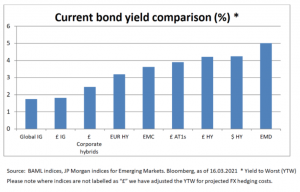

Another aspect of an unconstrained approach and an expansion of the investable universe is the ability to look in more places for the most attractive/best value investments. This can include Investment Grade, High Yield, emerging markets, subordinated financial debt and securitised debt markets. In turn, this supports a ‘high conviction’ approach. In the context of the generalised strong recovery in credit spreads, this ability to look more widely gains added importance.

Beyond duration adjustment, unconstrained credit investors tend to have many more tools at their disposal to cope with potential inflationary threats. For example, there is normally scope to increase exposure to lower rated credits and subordinated debt, which typically tend to be more immune to rising inflation.

In addition, an unconstrained approach usually means the ability to invest in floating rate bonds, where any upward moves in interest rates triggers compensating upward adjustments in coupon payments.

Needless to say, judgement and selectivity would be very important in such cases because moving down in ratings and different bond structures brings additional risks. Other strategies that can be explored for inflation protection include inflation swaps and real yields.

Focus on total return

To conclude, an environment of rising inflation, or even just rising inflation expectations, usually implies increased yield volatility. This calls for a more flexible approach to bond investing. An unconstrained investing approach that focuses on total return has produced strong returns in the past and is well equipped for differing economic conditions.

More specifically, an expanded investable universe provides more tools to defend against rising inflation and for mitigating downside risks more broadly. At the same time, an unconstrained approach is more suited for investing tactically and selecting high conviction investments.

Mark Munro is an Investment Director at Aberdeen Standard Investments. Mark is a Portfolio Manager in ASI’s Credit team for Sterling Investment Grade Credit Funds and is also the manager of the Total Return Credit and Ethical Bond funds. Mark joined in 2013 from Scottish Widows Investments Partnership where he worked as an Investment Manager on the Corporate Bond Team, with responsibility for Sterling and Euro credit funds. Mark is a CFA charterholder and has a Bachelor of Law (LLB) from the University of Edinburgh.

Mark Munro is an Investment Director at Aberdeen Standard Investments. Mark is a Portfolio Manager in ASI’s Credit team for Sterling Investment Grade Credit Funds and is also the manager of the Total Return Credit and Ethical Bond funds. Mark joined in 2013 from Scottish Widows Investments Partnership where he worked as an Investment Manager on the Corporate Bond Team, with responsibility for Sterling and Euro credit funds. Mark is a CFA charterholder and has a Bachelor of Law (LLB) from the University of Edinburgh.