In recent months, several high-profile US companies across a range of sectors, including Meta, McDonald’s, Walmart, Bank of America and BlackRock, have rolled back their diversity, equity, and inclusion (DEI) initiatives. These changes have raised concerns among some investors who want to understand the potential impact on corporate ESG risks and broader implications.

A new study entitled DEI Rollbacks: Impact on ESG Risk Ratings and Broader Implications for Investors examines the potential impact that announced changes to DEI initiatives may have on corporates’ ESG Risk Rating. The study goes on to suggest ways investors can evaluate the changes to discern whether they represent a material ESG risk, or merely a reframing of public disclosure on DEI.

Hortense Bioy, head of sustainable investing research at Morningstar Sustainalytics, commented: “Diversity programs have become widespread within the business community, with more than 80% of the 20,000+ companies assessed by Sustainalytics having such initiatives in place. Consequently, recent DEI rollbacks have raised concerns among investors as many firms view diversity as beneficial for business.

In the months ahead, investors will have the opportunity to closely examine the disclosure of DEI initiatives as companies have just started to update their corporate reporting. Investors may want to assess whether the perceived DEI rollback signals meaningful changes in corporate policy that could heighten ESG risks or just a reframing of public discourse on DEI.”

Key insights from the report include:

- Separating Material Change from Cosmetic Change. Investors should not expect all reported rollbacks in diversity, equity, and inclusion (DEI) initiatives to have the same implications. Some changes represent material shifts in corporate policy, potentially resulting in increased ESG risks, but others are just a reframing of public discourse on DEI.

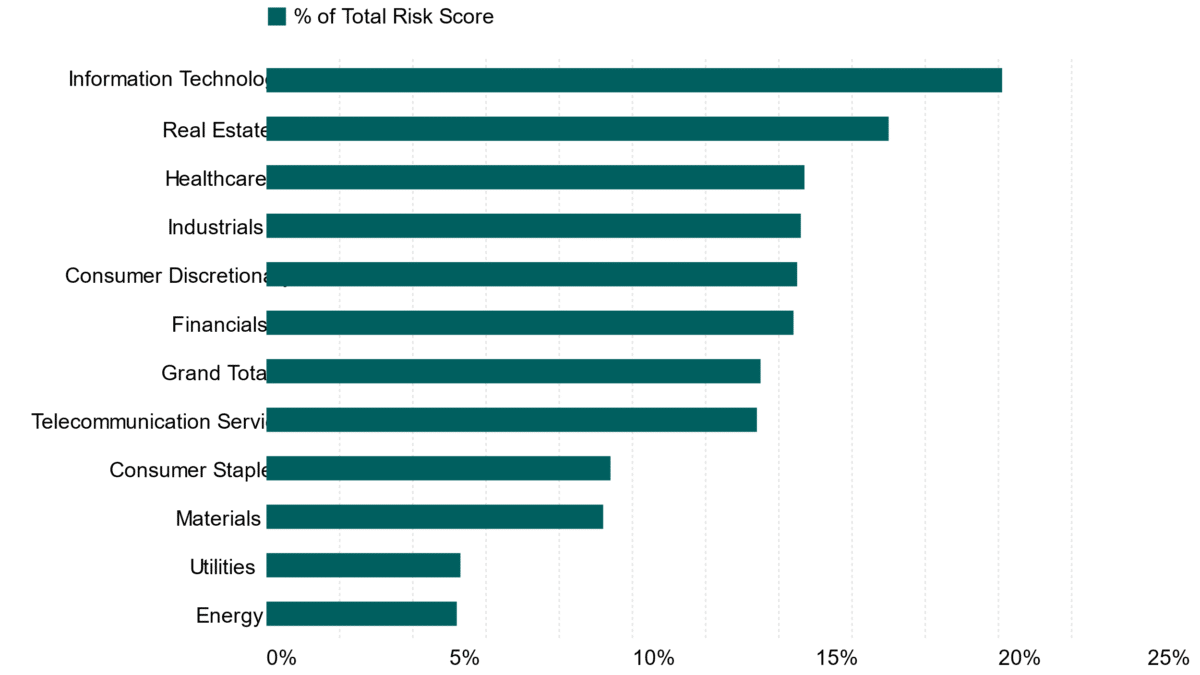

- Putting DEI in Context With Respect to ESG Risk. Given the relatively low weight of DEI in Sustainalytics’ ESG Risk Rating, we do not anticipate significant changes to overall ratings.

- Potential Long-Term Impacts. Despite limited financial materiality, investors may be concerned about broader implications, including societal impacts and potential weakening of other ESG commitments, such as climate risk disclosure.

Average Human Capital Risk Score as Percentage of Total Risk Score by Sector