It is conventional wisdom that investment decisions are usually informed by an assessment of the investor’s willingness to take risk (their risk profile). But what is investment risk? It is usually defined in two broad ways. First is by looking back at a very similar investment to see how much money it would have lost from peak to trough. Higher historic losses are linked to higher investment risk. Second is the variation or volatility in the return of a similar investment. Smoother returns are seen as safer. These two definitions help explain why investments in listed companies (equities) are seen as high risk – they can fall a lot, and returns are volatile. Lending money to companies and governments (bonds) is seen as lower risk for the opposite reasons.

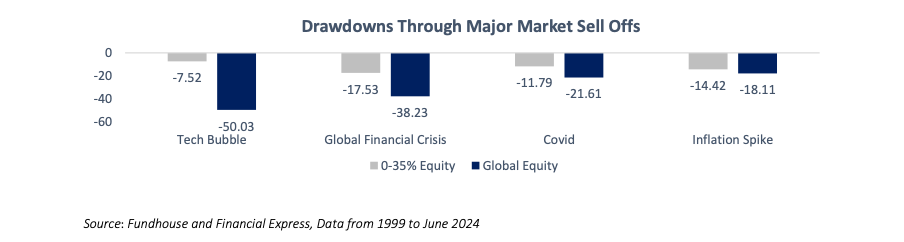

But, what if you lost less money, but it took longer to recover your losses? Is that still lower risk? Next, we compare a low-risk investment (the IA sector 0-35% shares – mostly bonds) to a high-risk investment (the IA Global sectors, which is usually 100% shares). In all cases, equities fall more major market sell-offs:

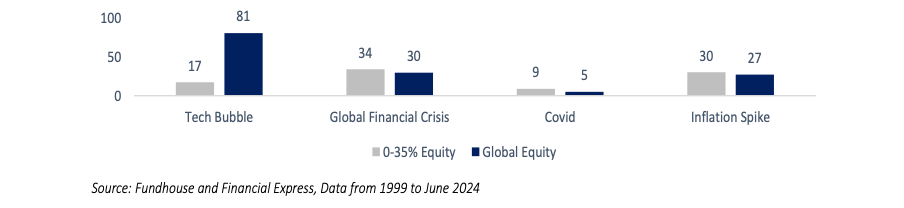

Yet, in all cases, bar one, the next chart shows that higher-risk investments (equities) recovered losses quicker than lower-risk investments (ones that are mostly invested in bonds). Below, we measure the recovery period as the period taken from peak to recovery, not drawdown to recovery. Note that the 0-35% sector has still not recovered from the inflation-driven sell-off in 2024 on the right:

Months To Recover From These Sell Offs

Investing is complex, and risk is not always what it seems. When building model portfolios, we are very aware of this risk and ensure that bonds are not simply seen as diversifiers. They must have investment merit.